Sunday, June 11, 2017

NQ Guideline For Monday

Last Friday, extremely large sell program was triggered hitting NQ index very hard. NQ dropped down over 240 points in just over four hours of trading before the end of day buying was able to push NQ back up about 100 points into the close.

The goal of the sell program was likely to drive momentum traders and capital away from tech stocks and into banking stocks in order to help the banks that are getting squeezed by the flattening yield curve.

The selloff in tech stocks may continue this coming weeks because the FOMC is going to raise short term interest rate by 0.25 points on Wednesday flattening the yield curve.

Key price level to watch in NQ is 5735 on the September contract.

-- As long as NQ remains above 5735, selling is likely to get overwhelm buy buying.

-- However, should NQ break back below 5735 and then remains below 5735, selling can get out of control. If so the next strong support is not until 5460-5480 price level, which is not very far away. With most traders and investors long the market, there are just too few buying left to buy when selling begins.

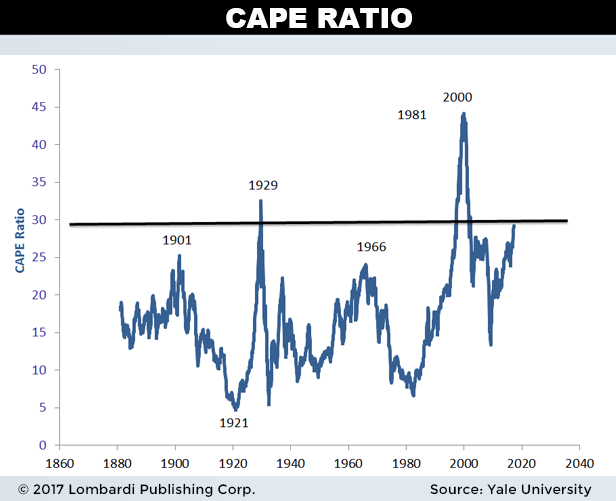

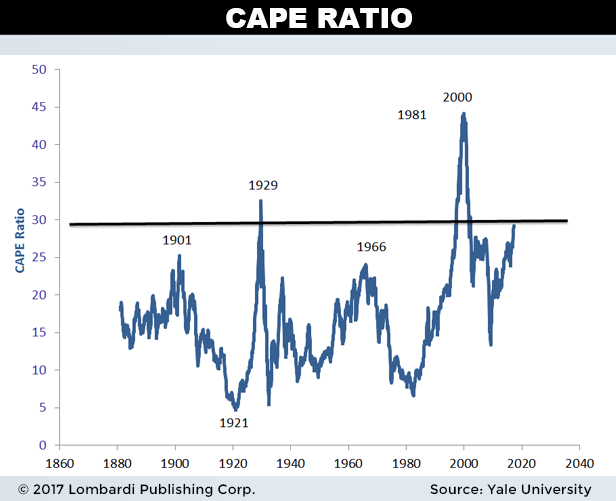

With CAPE ratio so high, stock market crash is a high possibility

The cyclically adjusted price-to-earnings ratio, commonly known as CAPE, Shiller P/E, or P/E 10 ratio, is a valuation measure usually applied to the US S&P 500 equity market. It is defined as price divided by the average of ten years of earnings (moving average), adjusted for inflation