Wednesday, May 31, 2017

NQ Guideline For Thuirsday

Pump and dump action continued on Wednesday. After opening with a huge gap-up to a new high for NQ on Wednesday sellers dumped huge amount stocks, tanking the market quickly down, then reversed back up, targeting another higher high before dumping another huge amounts of stocks.

The pump and dump activities is a typical topping price actions where insiders unload their positions when everyone else is still bullish and buying. The frequency of this type of price actions is going to intensify, and for a while longer, where each higher high is followed by a big stock dump.

With NQ back above its 200-MA on the 5-minute chart at the end of the day Wednesday, NQ should now make another higher high as long as it stays above it on Thursday.

Its 200-MA now sitting at 5692 is key support for NQ on Thursday

Long-term Chart of the S&P 500

Thursday, May 25, 2017

NQ Guideline For Friday

The Fed desperately want to cause a massive rally into the long memorial day week end, in order to paint a rosy picture of the economy even though the economy is quickly rotting from within.

Money creation to support the market continues at an accelerated rate. The three major central banks created one trillion dollars just in the first three months of 2017, just to keep economic collapse at bay and stock market elevated.

Relentless buy programs designed to trigger a big rally on Thursday started all nigh on Wednesday night, and by the opening bell, it was clear the stock market is going to open with a huge gap-up, and it did for NQ.

NQ opened with a huge gap-up and then rallied all day into the close. Thursday type of price action is often followed by a consolidation day, so on Friday it is very likely going to be a choppy consolidation day, unless of course they would trigger another large buy programs.

Key support is now at 5727.

Wednesday, May 24, 2017

NQ Guideline For Thursday

Another slow and choppy up day in the market on Thursday, and the same pattern should continue into Thursday and Friday as market manipulator is not going to allow the market to sell-off ahead of the long weekend.

Key support for NQ on Thursday will be 5710.

-- NQ remains in a bullish mode above 5710.Trader: "The Plunge Protection Team Is Happening In Bonds... Right Out In The Open"

Tuesday, May 23, 2017

NQ Guideline For Wednesday

NQ traded sideways above Monday swing high, and without any new buyers left to buy, except the Fed buying algorithm, the slow and choppy price action is likely to continue until NQ makes a new higher high and insiders selling comes in to whack the market back down.

It is going to take several more months before the buying algorithm could get overwhelmed by deflationary selling, until then, they are going to continue to pump and then rinse, again and again.

Key NQ support for Wednesday will be 5690.

-- As long as NQ pullback can stay above 5690 another higher high is to be expected.

Monday, May 22, 2017

NQ Guideline For Tuesday

The pump-and-dump actions in the stock market continues. Usually after a sharp selloff they would turn around and pump the stock market up, usually to another higher high in order to get insiders out of their long positions at great prices before their buy programs gets overwhelmed by market deflationary forces.

Sharp selloff followed by a rally to higher high should continue for a while. With the US going into a long memorial day weekend, look for buy programs to continue on Tuesday.

As long as NQ remains above key support, 5670-5675, NQ should remains in a bullish mode but likely trading in a choppy price action.

Memorial Day Weekend

Sunday, May 21, 2017

NQ Guideline For Monday

On Friday, with the opening above key 5645 inflection price level, as expected NQ traded sideways. This market just do not have any buyers left, and topping distribution activities is going to continue.

The stock market is going to gyrate at more and more frequent rate as sharp selling is going to met by Fed buy programs, but they would eventually get overwhelmed, simply because the economy is likely already in recession, and debt deflation is going to accelerates.

Key price level remains at 5645 on Monday.

-- If NQ remains above 5645 we can expect more consolidation above 5645.

-- Breaking back below 5645 implies NQ is going to consolidates below5645.

--NQ needs a clear and sustained break below Thursday low to trigger another rounds of selling. If so, the next support is 5450-5500

Sears is Dying. Once a mighty giant retailer, Sears is now on life support and dying. Many investors are also going to suffer.

Thursday, May 18, 2017

NQ Guideline For Friday

After a brief false break below Wednesday swing low NQ quickly rallied up, a sideways consolidation pattern, an up day.

Because Friday tends to be a choppy sideways consolidation type of day, depending on where NQ trades on Friday in relation to its key inflection price level, which is 5645, it either consolidates sideways below 5645 or consolidates sideways above 5645.

-- Failure to break back above 5645 implies a sideways consolidation between 5575 - 5645.

-- Breaking back above 5645 is likely to trigger short-covering, with resistance at 5670-5690, and NQ consolidating between 5645 - 5690

NQ needs a clear and sustained break below Thursday swing low to trigger another round of selling. If that happens, the next strong support level is 5450-5500.

The Three Biggest Central Banks Trying to Stop Global Deflation, but they will fail.

Wednesday, May 17, 2017

NQ Guideline For Thursday

With most investors long the market, Tuesday overnight selling continued into the open and into the morning trading session running over trailing stop-losses along the way.

Attempted reversal at noon failed to reversed the trend as the Fed buy programs continued to get overwhelmed by margin selling in the afternoon.

The Dow closed the day with over 370 points down and NQ over 100 points down. Whether or not this is a typical one day selling, or more selling to come, will depend on where the market trades on Thursday

For NQ, key support on Thursday will be Wednesday swing low.

-- Staying above Wednesday swing low should keep sellers under control, implies a sideways consolidation trading pattern or a rally day.

-- A sustained break below Wednesday swing low is going to trigger another round on uncontrollable selling activities, and the next strong support is 5450 to 5500 prior swing high on the daily chart.

Tuesday, May 16, 2017

NQ Guideline For Wednesday

The Fed continues to target the five FAANG stocks to keep the stock market up and to create an illusion that all is well. Although Nasdaq continues to make a new high on a daily basis due to the FAANG stock, the broader is not.

The economy is starting to rot from within. Retail sales are down, shopping malls are closing down at unprecedented rate. Auto sales are down drastically. Ford just announced that it is cutting 20,000 jobs worldwide.

Support for NQ on Wednesday will be at 5705.

-- As long as NQ remains above 5705 selling should remains very minimal, and buying should continue, the next target up is another higher high.

Monday, May 15, 2017

NQ Guideline For Tuesday

In order to keep the stock market at elevated level, the Fed buy programs continues to target the five Nasdaq stocks, including Apple, Google, Amazon, Facebook, Netflix.

While NQ continues to make a new higher high almost on a daily basis, the Dow and the S&P 500 index continues to trade below March swing high as insiders continues to sell ahead of the bear market.

Support for NQ on Tuesday will be 5680.

-- s long as NQ remain above 5680 on Tuesday we can expect another new record high. Because there is no more buyer at these high level the rally should continue to be slow, narrow range and choppy.

The Race has been on for some time between the three of the biggest Global Central Banks to see who can expand their balance sheets the most before they fall off the cliff into the deflationary abyss. And of course take the world down with it .

Thursday, May 11, 2017

NQ Guideline For Friday

The stock market is in a topping pattern which started in March, normally lasting six month before the market can trend down in a sustainable way. Until then the market should continue to seesaw up and down inside a range that should get wider and wider with time.

On Thursday the market trend down in the morning, then central banks buying hit the market and pushed the market back up into the close. This type of price action should continue for the next three months, morning selling should be met with heavy buying activities by lunch and into the close.

Tomorrow is Friday, and the usual Friday patterns is a non-trending sideways consolidation pattern as traders balances their books for the weekend.

Key price level for Friday will be again be 5665.

-- If NQ remains above 5665 at the open on Friday look for NQ to rally to a new high before pulling back down on profit-taking.

--Trading back below 5665 is an indication NQ is going back down to retest Thursday morning low. As long as the market internals is not in extreme bearish mode NQ should then rally back up to 5665 price level.

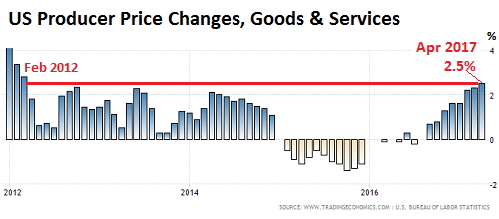

The Fed Gets another Reason to Raise Rates in June, Inflation at the Producers level is up.

Wednesday, May 10, 2017

NQ Guideline For Thursday

NQ traded in a choppy and narrow range sideways trading pattern on Wednesday. There is no more new buyers but no one wants to sell simply because everyone long the market is just waiting for the Fed to continue to push the market upwards.

Short term intraday NQ support for Thursday will be 5665. As long as NQ remains above 5665, it is going to try to make another new high.

Tuesday, May 9, 2017

NQ Guideline For Wednesday

After making another higher high NQ traded sideways all day. Nasdaq rally is fueled by a few stocks, AAPL, GOOG, FB, the Fed's favorite stock to buy in order to keep the stock market sentiment positive.

The market rally breath is getting worse by the day, and clearly making a major top like the 2000 and 2007 market top that should be followed by major bear market unless central banks prefers the hyperinflation route.

The Dow and the S&P 500 lags behind nasdaq, a typical major topping pattern, which started March 2017. major topping pattern normally last about six months, which puts the beginning of a bear market down leg should starts in September 2017.

Between now and September 2017 the market should continue to trade sideways inside a trading range that should continue to get wider and wider.

On a short term intraday timeframe, support for NQ is 5655. As long as NQ remains above 5655, we should see another higher high in NQ.

$SPXA200R is a breadth indicator showing the percentage of S&P 500 stocks above the 200-day moving average. $SPXA200R declines when more S&P 500 stocks cross below the 200-day moving average.

Monday, May 8, 2017

NQ Guideline For Tuesday

Another slow and choppy up day in the stock market on Monday. With major central banks continuing to flood the market with liquidity, about $1 trillion dollar so far this year in 2017, the stock market may just continue to melt up into hyperinflation without the traditional deflationary period before hyperinflation.

With the Fed certain to raise their short term interest by 0.25% in June they are very likely to continue to flood the market with liquidity in order to prevent stock market and bond market collapse when they announces their decision in June.

However because there is really no more buyers, the market may just melt up slowly, and then explode into stratosphere when hyperinflation hit.

On the intraday chart NQ support on Tuesday will be 5630.

Zimbabwe Industrial Index exploded into stratosphere when hyperinflation finally hit. In just 2 years after hyperinflation hit, from 2005 to 2007, Zimbabwe Industrial Index went up from several thousand to 4 million

Sunday, May 7, 2017

NQ Guideline For Monday

With a win by the establishment candidate Macron in the French Presidential election the stage is set for more buy programs in order to paint a positive reaction to the win by the establishment candidate.

For NQ key support will be 5625.

-- As long as NQ remains above 5625 on any pullback, the uptrend should continue.

Thursday, May 4, 2017

NQ Guideline For Friday

On Thursday NQ again traded sideways in a choppy narrow range trading pattern, stucked between 5600 support and 5630 resistance.

Friday could be a repeat of Thursday trading pattern inside the same 5600-5630 trading range unless they trigger buy programs that could push NQ up above 5630 and keep NQ above 5630.

The French election could have some influence over Friday's trading pattern, with most pundit expecting Marine Le Pen to lose to Macron. However, an unexpected victory by Le Pen could cause some trading volatility come Monday next week.

Wednesday, May 3, 2017

NQ Guideline For Thursday

A very narrow range sideways trading pattern for NQ on Wednesday. There was barely any noticeable reaction to the FOMC policy statement on Wednesday simply because everyone know the Fed was not going to do anything.

Choppy narrow range trading pattern should continue into Thursday and Friday simply because everyone is now long the market and no one want to get off the trade because they are just waiting for the Fed to continue buying the market, and pumping liquidity into the system knowing the economy is going into recession very soon, and hoping that by flooding the market with counterfeit credit they can avoid a recession.

Trading range for NQ on Thursday will be 5595-5600 as support and 5625-5630 as resistance.

U.S. Auto Sales Plunge Dramatically As The Consumer Debt Bubble Continues To Collapse. Every single major U.S. auto manufacturer missed their sales projections in April.

Tuesday, May 2, 2017

NQ Guideline For Wednesday

On Tuesday, ahead of the FOMC decision on Wednesday which most analysts expecting the FOMC to not do anything, the stock market traded sideways in a narrow trading range.

The pattern should continue until the FOMC officially announces their decision in the afternoon on Wednesday. After the announcement, the market could have a reaction, positive or negative, but I would expect buy programs should be very active, and any selling could be met with massive buy programs.

On any selling, 5595-5600 would be a strong support.

Monday, May 1, 2017

NQ Guideline For Tuesday

At market top, technology leads the rally while big cap stocks lags, and that is precisely the condition the stock market is currently in, with Nasdaq leading to the upside and the Dow and S&P 500 still lagging behind, still trading below their respective March swing high.

This is precisely the market configuration at the 2000 market top and at the 2007 market top before brutal bear market sets in. This time it will not be any different. The only question is the precise timing of the first official bear market down leg.

Buy programs continued to target a few large cap technology companies just to paint a very rosy tape to get more investors trapped for the fall, and it was Apple on Monday. Market breath continues to get worse.

NQ is in deep overbought level on the daily chart, but buy programs remains very active and is likely to continue on for a while until some unexpected outside event triggers selling, and because almost everyone is now long the market and just enjoying the benefit of buy programs powers by free money, trailing stops would turn into selling, and the market crashes. Until then, everyone is onboard for the bull ride.

Subscribe to:

Comments (Atom)