Monday, October 31, 2016

NQ Guideline For Tuesday

NQ traded sideways in a very narrow range on Monday hovering mostly above 4800 well defended price zone. Whether or not NQ would have to bounce for 4800 before finally crashing down below it only time will tell.

But 4800 price support zone is getting weaker and weaker by the day, and with more and more stop-losses congregating just below it, a clear and sustained break has the potential to quickly tank NQ down to the next support level, 4700.

On the 5-minute timeframe, key price level for NQ on Tuesday will be 4820.

-- If the Fed can push NQ above 4820 and keep it above 4820 selling should remains muted and under control.

-- Failure to push NQ back up above 4820 resistance is bearish but NQ would need to clearly break below 4800 to trigger selling algos. In case of a clear break below 4800, the next lower support is 4700.

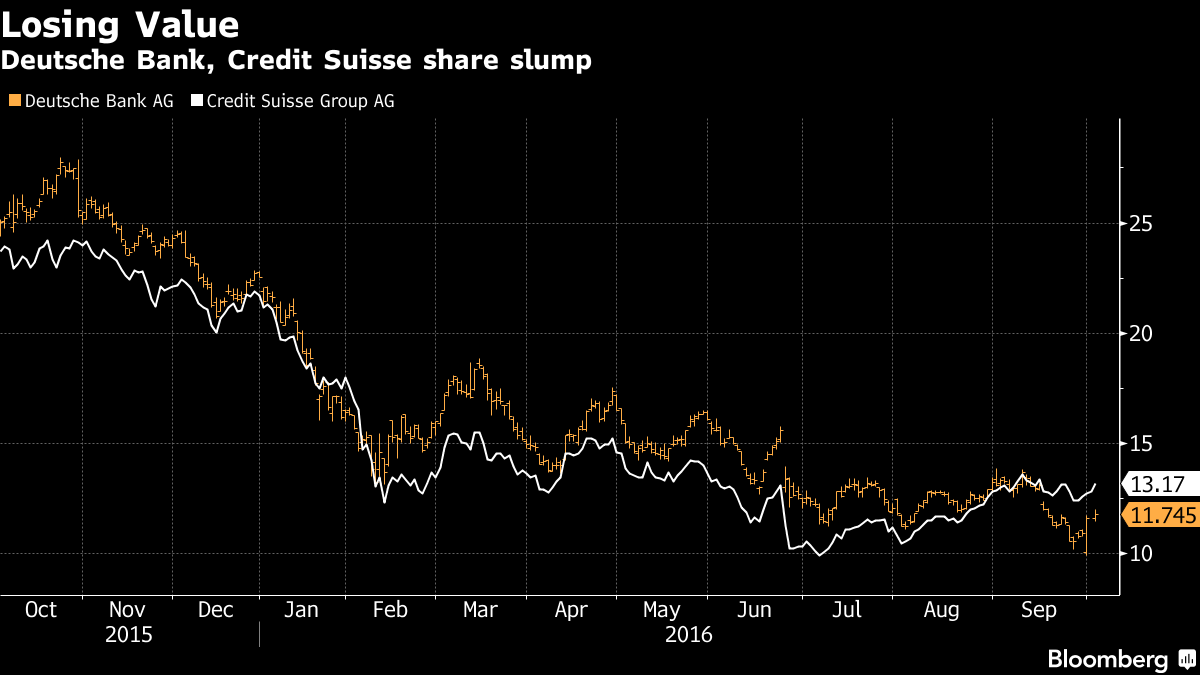

Moody’s: Deutsche Bank Nearing “Default Point”. In a research report put together by the credit agency’s ‘Analytics’ research division, Moody’s analysts write that Deutsche Bank expected default frequency remains at one of the highest levels in the banking industry, despite the bank’s efforts to shore up its capital position.

Sunday, October 30, 2016

NQ Guideline For Monday

NQ traded sideways on Friday, staying mostly between 4800 support and 4840 resistance. The fact that NQ breached that 4800 critical support level several times on Friday is an indication that 4800 support may be ready to break next time it gets tested.

Early Friday morning ramp failed to get NQ to break above 4840 resistance, and when the early afternoon re-test of 4840 failed to break above it, aggressive selling activities came into the market and sold NQ hard. 4800 price level continued to be aggressively defended, but it has been weakened.

Deflationary forces continues to drag the market down, the market looks very vulnerable to heavy selling. Bearish momentum divergence on the daily chart continues to get more pronounced.

On the short-term timeframe, key price level for NQ on Monday will be 4840.

-- If the usual overnight ramp could not keep NQ above 4840 sellers will come back in, support remains at 4800.

-- Staying above 4840 should keep sellers at bay. However, it would requires massive buy programs to push NQ above 4840.

Italy’s Banking System on Verge of Nervous Breakdown

Thursday, October 27, 2016

NQ Guideline For Friday

For Friday, another large down bearish day, or a sideways consolidation day. The key support is 4800.

A large selloff in the equity market on Thursday. NQ opened with a large gap-up, but selling commenced immediately and continued into the close. The closing price for NQ was just above key support of 4800.

Amazon's earning misses announced after the market was closed on Thursday could have a strong negative influence for trading on Friday. A break below 4800 is likely to trigger an avalanche of sell orders, the next support is 4700. However, with the Fed not willing to let the market selloff before the November presidential election, look for 4800 support level to be well defended.

On the 5-minute time frame, key price inflection level will be at 4840, with strong resistance at 4860 and strong support at 4800.

Amazon misses on earnings, stock down 5%

A large selloff in the equity market on Thursday. NQ opened with a large gap-up, but selling commenced immediately and continued into the close. The closing price for NQ was just above key support of 4800.

Amazon's earning misses announced after the market was closed on Thursday could have a strong negative influence for trading on Friday. A break below 4800 is likely to trigger an avalanche of sell orders, the next support is 4700. However, with the Fed not willing to let the market selloff before the November presidential election, look for 4800 support level to be well defended.

On the 5-minute time frame, key price inflection level will be at 4840, with strong resistance at 4860 and strong support at 4800.

Amazon misses on earnings, stock down 5%

Wednesday, October 26, 2016

NQ Guideline For Thursday

A bearish day in the equity market on Wednesday after Apple earning report announcement on Tuesday. The forces of global deflation is starting to overwhelm central banks buying programs. Unless central banks are willing to create more currency than the forces of deflation destroys the beginning of a major stock and bond market collapse may not be very far away.

Bearish momentum divergence on the daily chart continues to get more intense, key support level for NQ remains at 4800. A clear and sustained break below 4800 is likely to trigger massive selling algorithms that is likely to overwhelm the Fed.

On the short term intraday timeframe, key price level for NQ on Thursday will be 4860.

-- Trading above 4860 should keep sellers at bay, with the next resistance at 4880.

-- NQ will be under selling pressure below 4860 with the next support at 4840. If 4840 does not hold on Thursday it is likely to trigger algo sell programs that can quickly tank NQ down to key support at 4800.

Another clear sign of deflation, woe in the oilfield: In total, 213 North American oil and gas companies have now filed for bankruptcy since the start of 2015, listing more than $85 billion in debt.

Tuesday, October 25, 2016

NQ Guideline For Wednesday

There was no follow-through buying on Tuesday as NQ traded sideways down towards support, then closed right at support for Wednesday 4885.

For Wednesday 4885 needs to hold to keep sellers at bay. Should it clearly breaks, look for selling to come in aggressively. If so, the next support is back at 4855, then a bounce back up from 4855 or a break-down to 4800 key support level.

NQ chart on the daily timeframe is showing a clear bearish momentum divergence, with deflationary forces intensifying, should NQ re-break back below 4800 look for selling to get out of control.

'Europe is extremely sick', says Deutsche Bank chief economist. Monte dei Paschi trading suspended after 23% stock plunge. Shares in Italy’s Monte dei Paschi di Siena bank have been temporarily suspended from trading after a 23 percent price drop. This followed the stock's initial rally on Tuesday after the bank announced its latest plan to secure survival.

Monday, October 24, 2016

NQ Guideline For Tuesday

A usual, massive buy programs triggered during low volume globex trading on Sunday night caused a huge gap-up open on Monday. The buy programs continued all day with NQ closing at the high of the day.

The Fed buy programs which tends to be more active at night is likely going to continue until the US presidential election in November to ensure Hillary Clinton's victory.

With Monday's massive gap-up opening, key support for NQ has now climbed up to 4875.

-- As long as NQ can remains above 4875, selling should be kept at bay, and NQ either consolidate the huge gains on Monday or rally again particularly if they are going to trigger another huge rounds of buy programs.

-- Breaking back below 4875 could trigger some selling, with the next support at 4855. Without any major market moving news releases, 4855 should provide some good support on any selling activities.

Sunday, October 23, 2016

NQ Guideline For Monday

NQ continued to trade sideways and last Friday trading session was no different, as NQ traded sideways in a narrow trading range between 4800 support and 4855 resistance. In the meantime, bearish divergence on the daily chart is getting more and more obvious.

Key price levels for NQ on Monday will be 4855 resistance.

-- A clear and sustained break above 4855 is likely to keep selling at bay. However, failure to break and or stay above 4855 is likely to attract some selling.

-- Staying below 4855 could attract some selling, but strong support remains at 4800. The market would need to be really bearish to break below 4800 support.

European banks are in dire situation. Brussels Contemplates Outlawing Short Selling on European Bank Stocks

Thursday, October 20, 2016

NQ Guideline For Friday

As the US presidential election gets closer, the Fed is going to ramp up their buy programs in order to hold the market up to ensure Clinton's victory.

For NQ, 4800 price level remains a well defended support level, and will be support again on Friday. Resistance remains at 4855, and during a regular trading hours, it would need massive buy programs to clearly break above 4855. Many buy programs tends to be triggered during globex trading hours when volume is low.

Bearish divergence on the daily chart remains intact.

Wednesday, October 19, 2016

NQ Guideline For Thursday

Even with the Fed best effort to push the stock market up in order to ensure that banker's puppet Hillary Clinton win the next presidential election, the stock market continues to struggle, and the bearish divergence on the daily chart continues to weight on the market.

NQ looks ready to tank at any moment. The Fed knows it and will do whatever they can to push the market upward.

Key resistance for NQ remains at 4855 and key support for NQ remains at 4800. NQ is going to remains choppy inside the 4800 - 4855 trading range.

Crude Oil: A weekly close (above $52.08), if seen, would confirm the pattern which would then target $77, in line with the lows from 2011 and 2012. The 200 week moving average is around $72.”

Tuesday, October 18, 2016

NQ Guideline For Wednesday

A huge gap-up open on Tuesday failed to trigger any buying activities in the stock market as selling came back in the afternoon. NQ sold off hard, erasing most of the gap.

The battle between central banks buying programs and deflationary forces is going to continue. The Fed is desperately trying to hold the stock market up to avoid Trump victory in the upcoming presidential election.

But with the ratio of bullish asset to bearish assets currently at the highest level since the year 2000, just before a major stock market collapsed, looks for the Fed buy programs to get overwhelm by deflationary forces in not too distance future.

Key price level for NQ on Wednesday will be 4855, now acting as resistance, and support remains at 4800.

DANGER: The Last Time This Happened Was Right Before The Stock Market Collapsed!

Monday, October 17, 2016

NQ Guideline For Tuesday

NQ traded sideways again on Monday, oscillating above and below key 4800 inflection price level, and spending more time below 4800. If the Fed is unable told it above 4800, seller may get more aggressive.

Key inflection price level for Tuesday will remains at 4800.

-- Trading above 4800 should continue to keep selling under control, but NQ has to clearly break back above 4840 to trigger some additional buying.

-- Staying below 4800 will make NQ vulnerable to heavy selling. Many stop losses are now congregating just below last week Thursday low, below 4755. A clear and sustained break could trigger an avalanche of selling.

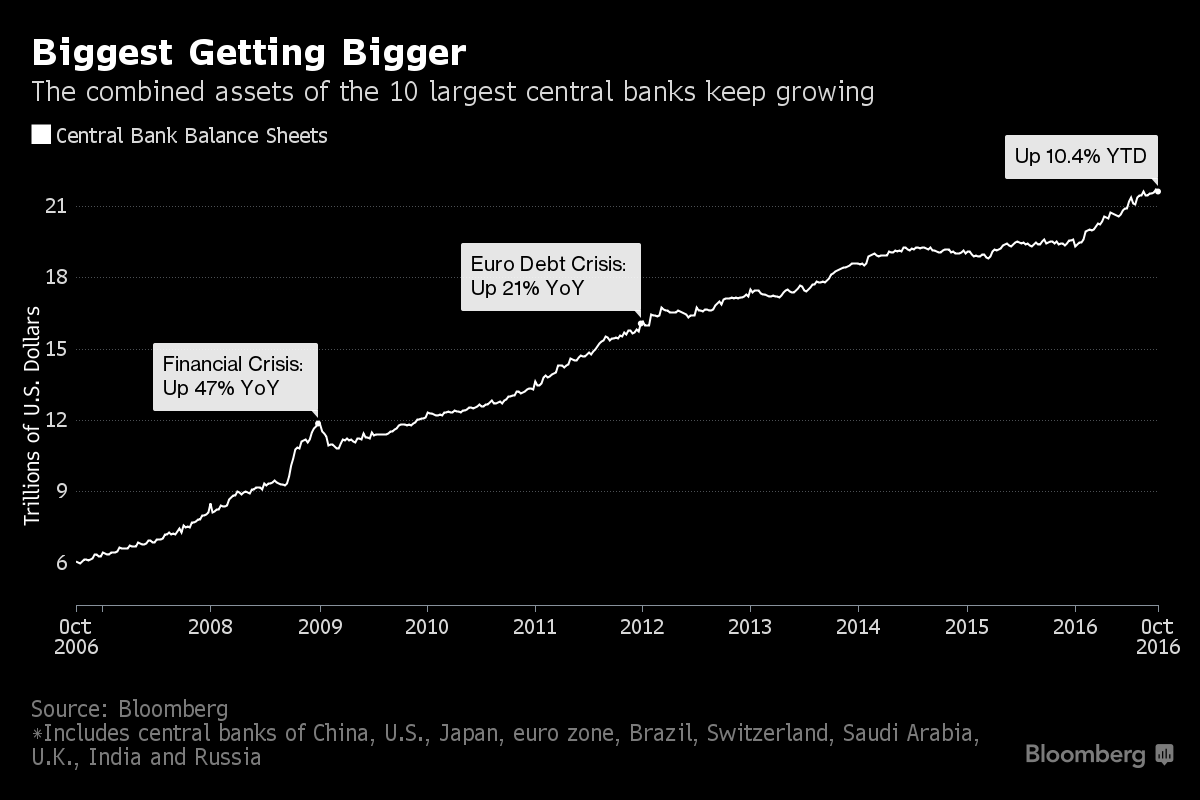

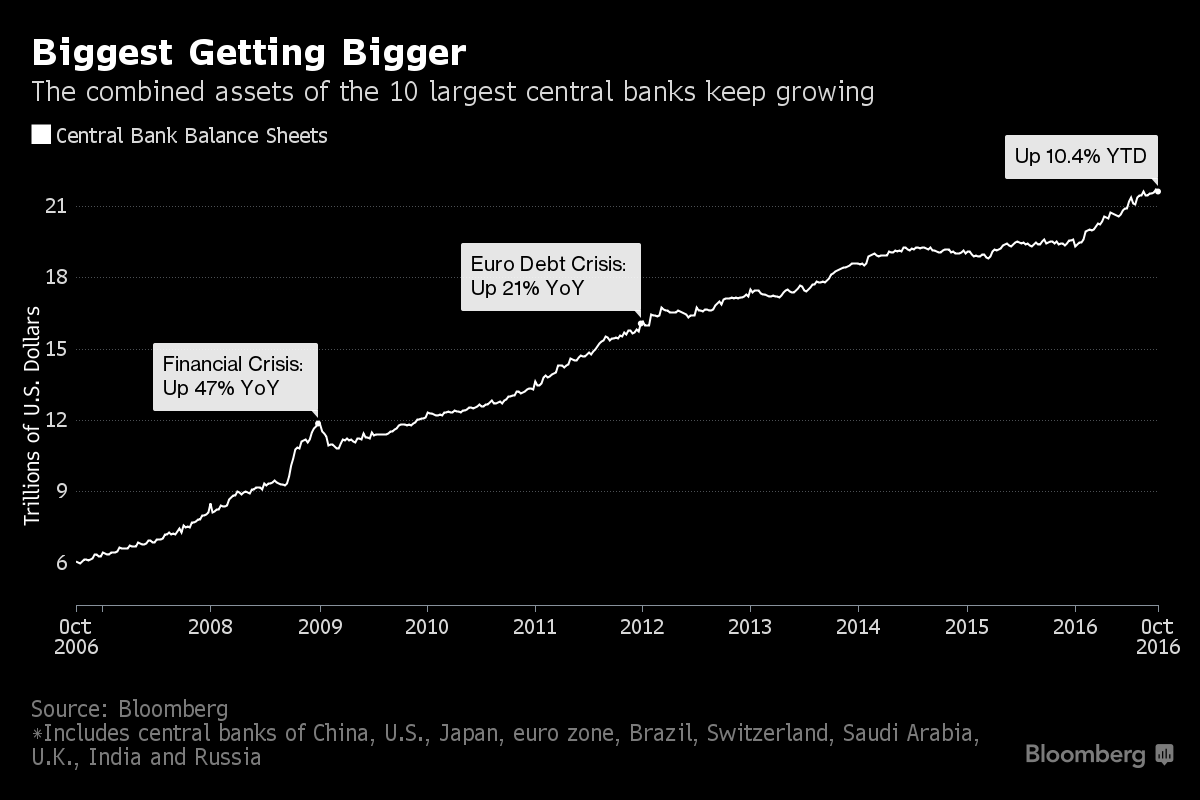

Chart Of The Day: Top Central Bank Assets Soar 10% to $21.4 Trillion

Chart Of The Day: Top Central Bank Assets Soar 10% to $21.4 Trillion

Sunday, October 16, 2016

NQ Guideline For Monday

NQ traded sideways on Friday, remaining above key 4800 support, helping to keep selling under control. Unless they are able to push NQ back up above 4840 it would remain vulnerable to selling pressure.

Key support for Monday will be 4800 price level.

-- Remaining above 4800 should keep selling under control, but it would have to break back above 4840 to get NQ on the bullish side again.

-- Breaking below 4800 could trigger another selling avalanche that can get out of control. Next support is 4750, then 4700.

As the European financial system is on the verge of collapse, central banks are standing ready to crank up the printing presses. These central banks are totally aware that an extended deflationary period would be the end of many major European banks and also the global financial system.

We are at the point now when a deflationary implosion could happen any time, caused by the collapse of Deutsche Bank or a major Italian or Spanish bank. European governments are not going to let this happen, and therefore a major European and global money printing package is not far away.

Thursday, October 13, 2016

NQ Guideline For Friday

The Fed monetary policy choices has gone into a no-win situation. It is a choice between saving the dollar from total collapse or saving the stock market from total collapse, and neither option is good.

With the stock market ready to crash, on Thursday, the Fed decided to let the dollar decline just in order to stabilize the stock market. The market was ready to sell off again at he open but a declining dollar managed to rally the market.

NQ has broken below key moving average support, the 20DMA and the 50-DMA. Unless NQ can rally back above those two moving averages, algo will remains in sell mode. Both S&P500 and the Dow futures remains above breakout support which helps keep selling under control. But the forces of global deflation is beginning to overwhelm central bankers.

Key short term price level for NQ on Friday will be 4800, currently acting as resistance.

-- Trading above 4800 should keep selling under control.

-- Selling could resume if NQ failed to break and stay above 4800. Keep an eye on the US dollar index.

Wednesday, October 12, 2016

Crash Alert - NQ Guideline For Thursday

On Wednesday the stock market consolidated Tuesday major selling activities, setting up another massive selling day.

By trying to save the dollar from collapsing the Fed is sacrificing the equity market. Strong dollar is very bearish for the global stock markets simply because there is so much debt denominated in the US dollar. The more the US dollar rally the worse the global economic conditions become.

The current market configuration is similar to the pre-1987 stock market crash. Unless the Fed change their policy, selling activities may get so intense that it would overwhelm the Fed buy programs and crash the stock market.

Key price level for NQ on Thursday is again 4800.

-- A sustained break below 4800 could quickly tank NQ down to 4700, but the final target of any down move below 4800 is 4450 - 4500, with 4700 price level that may cause a temporarily bounce.

-- NQ should remain either in a consolidation mode or rally if it remains above 4800.

Tuesday, October 11, 2016

NQ Guideline For Wednesday

The stock market sold off hard on Tuesday, three days ahead of money market reform that's due to come into effect on Oct. 14, overwhelming the Fed buyers. NQ sold off almost 100 points form last Friday closing price. NQ bounced off it very critical support at 4800.

Going into Wednesday, a clear and sustained break below 4800 could trigger an avalanche of selling that could quickly crash NQ down to the next major support at 4550, with potential support at 4700 area.

NQ key support on the short term time frame is 4800. But keep in mind that NQ daily chart is trying to confirm a massive bearish MACD divergence. A clear break below 4800 on the daily chart is likely to trigger an avalanche of sell orders, a down-move targeting 4450.

A $7 Trillion Moment of Truth in Markets is Just Three Days Away

Not since the financial crisis of 2008 has Libor, to which almost $7 trillion of debt including mortgages, student loans and corporate borrowings, is pegged — experienced such a surge. The three-month U.S. dollar Libor rate has jumped from 0.61 percent at the start of the year to 0.87 percent currently — a 42 percent rise — ahead of money market reform that's due to come into effect on Oct. 14.

The new rules require prime money market funds — an important source of short-term funding for banks and companies — to build up liquidity buffers, install redemption gates, and use 'floating' net asset values instead of a fixed $1-per-share price. While the changes are aimed at reinforcing a $2.7 trillion industry that exacerbated the financial crisis, they are also causing turmoil in money markets as big banks adjust to the new reality of a shrinking pool of available funding.

The new rules require prime money market funds — an important source of short-term funding for banks and companies — to build up liquidity buffers, install redemption gates, and use 'floating' net asset values instead of a fixed $1-per-share price. While the changes are aimed at reinforcing a $2.7 trillion industry that exacerbated the financial crisis, they are also causing turmoil in money markets as big banks adjust to the new reality of a shrinking pool of available funding.

Monday, October 10, 2016

NQ Guideline For Tuesday

On Monday NQ was engineered to opened with a gap-up but without buyers, it simply traded sideways in a very choppy narrow range price action. There was not much selling activities simply because NQ remains above support. The choppy price action is likely to continue unless they are willing to trigger massive buy programs.

On Tuesday, the short term 5-minute support will be at 4875.

-- As long as profit-taking selling does not violate 4875 support, the choppy rally should continue.

-- Clearly breaking below 4875 is likely to trigger some selling that could take NQ down to lower support, 4835 - 4845 support zone.

Chart Of The Day: Global Stocks-----Hanging By A Thread Of QE, Threatened By Sinking Growth

Sunday, October 9, 2016

NQ Guideline For Monday

On Friday, the stock market again traded sideways in a very narrow range. Unless it ccan break down below key support, the choppy sideways pattern should continue.

NQ has been trading sideways in a choppy narrow range, bouncing off 20-DMA support on the daily chart since the middle of September. Going into Monday trading, the 20-DMA support on the daily chart is around 4830. Absent of major market-moving news, NQ should continue to bounce off its 20-DMA.

Key inflection price level for NQ on Monday will be 4865.

-- Selling should be under control above 4865. However, with the bond market closed for Columbus day on Monday, look for the stock market to remains choppy and in a narrow trading range

-- Some selling may come in with NQ trading below 5865, but 4830 will serve as a powerful support. The stock market would need to be very bearish for NQ to clearly break below 4830 support.

According to JP Morgan’s September 30 Flows & Liquidity report, the pace of global bond issuance has risen significantly this year. According to the report, net bond issuance stands at $2.5 trillion so far this year, up by almost $400 billion compared to last year’s total.

This total excludes emerging market local debt but includes spread products – bonds issued outside central government. JP Morgan is forecasting a 55% rise in spread products supply for 2016 compared to 2015.

Thursday, October 6, 2016

NQ Guideline For Friday

As expected the market chop around on Thursday as it traded sideways in a vary narrow range all day long. Any attempted selling seems to continue to be bought by the Fed just to hold the market up for the presidential election.

The choppy pattern should continue on Friday as long as the market stays above major support, and for NQ that major support is 4800.

Important short term balance price level for NQ on Friday remains at 4865.

-- Selling should remains under control with NQ trading above 4865, likely staying in a choppy mode unless they trigger large buy programs for the weekend.

-- There might be some selling below 4865, but as long as 4800 support is not violated, selling should continue to be bought.

Wednesday, October 5, 2016

NQ Guideline For Thursday

Not much happened in the equity market on Wednesday as all the major indices simply traded sideways in a very narrow range. There is simply no buyers at these level, with the market in overbought territory.

There is also not much short-selling activities at these price levels as the Fed continues to buy the bids in order to hold up the stock market until the presidential election is over, hoping for Hilary Clinton to win.

Until the major indices have clearly broken below supports, most major selling algos will be in active, and without new buyers, the market could continue to chop around at these levels.

Price support for NQ going into Thursday trading will be 4865.

-- NQ is likely to continue to chop around in a narrow range above 4865 unless they could trigger massive buy programs that could overwhelm the forces of deflation.

-- There may be some selling coming in if NQ trades below 4865, but it should remains under control until NQ could clearly break below 4800 key support level.

Famed Investor Gundlach Says Negative Interest Rates Threaten to Decimate Banks

Tuesday, October 4, 2016

NQ Guideline For Wednesday

The battle between the Fed buy programs and natural forces of deflation continues on. On Tuesday NQ stayed above 4855 key inflection price level in the morning but failed to attract any buyers to help rally the market higher, then in the afternoon NQ broke below 4855, but late day buy program managed to push NQ back up to close right at 4855.

Also, n Tuesday the Fed whacked the paper gold market very hard, selling over 1,000 tons of paper gold, a desperate attempt to either save the dollar, or a prelude to either lowering interest rate in the November meeting, or a prelude to QE4 or simply to save the gold bullion bank from their deep under water short positions. Whatever the reason may be, it is a desperate attempt to prevent collapse.

For Wednesday 4855 remains key inflection price level.

-- Above 4855, selling should remain under control.

-- NQ would need to break below 4800 in order to trigger massive selling activities. Until then, NQ should remain in a choppy mode.

Former Soros Associate Says Fed Responsible For Gold & Silver Smash

Monday, October 3, 2016

NQ Guideline For Tuesday

Not much happened in the market on Monday as it simply traded sideways in a very narrow range. As long as NQ is still trading above its 20-day moving average support on the daily chart, now at about 4810, it could remain in a choppy up trending mode.

Short term key inflection price level for NQ on Tuesday remains at 4855.

European Bank Perfect Storm

Sunday, October 2, 2016

NQ Guideline For Monday

The battles between central banks and deflation continues. On Friday, buy programs managed to push the stock market up, an up day in the market, but the rally momentum on the daily chart is getting really slow, and a sharp selloff may not be too far away.

The Fed is going to continue to support the market into the November election in order to get banker-controlled Hillary elected for President simply because Trump is not really a banker-friendly candidate. Whether or not the Fed can really hold up the stock market against intensifying deflationary forces, only time will tell.

For Monday, short term key price level to watch is 4855, acting as support as of Friday's close.

-- Staying above 4855 should keep major selling activities at bay.

-- Trading below 4855 is likely to attract selling activities, next support is at 4800.

European banking stocks are dying under the weight of the negative interest rates, stock prices hitting lows

Subscribe to:

Comments (Atom)