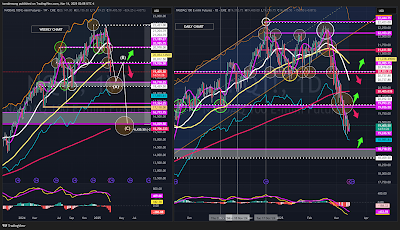

Two weeks of relentless selling sparked by President Trump economic policies, particularly the tariff war with the rest of the world has brought NQ down over 11% from its record high, that's over 2,500 NQ points.

Last week low was at strong support, a combination of prior pivot high and its 50-day moving average on the weekly chart. As as result, this week we could see massive 2 to 3 day rally, 1,000 NQ points, to relieve the oversold condition and to re-test broken support - now resistance at 21,000 price level before dropping back down.

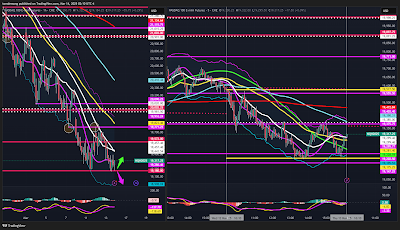

To do so it has to stay above 20,000 price level. A sustained break below it is an indication of a more serious problem, and would trigger another round of liquidation selling, targeting the next support level, 18,500.

On the intraday time frame, 20,200 is key inflection price level, bullish above it, bearish below it, with key intraday support at 20,000