Monday, September 30, 2019

NQ Guideline For Tuesday

-- NQ Daily trend = Down

-- NQ 60-minute trend = Up

-- NQ 5-minute trend = Up

NQ opened above 7700 intraday line-in-the sand on Monday, triggers short-covering that lasted all day with the close at the day high, just below 7800 strong resistance, setting up a break above 7800 to the next resistance 7840-7850, or pull back down to supports.

-- A break above 7800 target 7840-7850.

-- A failure to break above 7800 implies NQ is going back down to supports, with first support is 7750, then 7700

Inflection price level for NQ on Tuesday is 7770

Sunday, September 29, 2019

NQ Guideline For Monday

-- NQ Daily trend = Down

-- NQ 60-minute trend = Down

-- NQ 5-minute trend = Down

The stock market sold off hard on Friday, with NQ dropping over 170 points from the day high. NQ managed to pull back up near the close where it closed at key inflection price level for Monday's trading.

The inflection price level for Monday is 7700.

-- Trading above 7700 may cause some short term algos to cover their shorts. If so, we can see NQ moving back up to resistances, 7740, then 7800.

-- If NQ should trade below 7700 on Monday we could see heavy selling, downside target is 7400, and it is not so far down.

Thursday, September 26, 2019

NQ Guideline For Friday

-- NQ Daily trend = Down

-- NQ 60-minute trend = Up

-- NQ 5-minute trend = Up

NQ A sideways consolidation day for NQ on Thursday, with the open below key resistance 7840, then dropping down to support 7740 before reversing back up closing right in the middle of the day range.

With trends from various timeframes in conflict with each we could see another consolidation type day tomorrow particularly when Fridays tend to be choppy, unless of course the daily trend starts to exert its downtrend on Friday.

The 60-minute trend is setting up for a bullish move.

The daily trend is setting up for a bearish move

The 5-minute trend is neutral, and can go either way

Key intraday price level for Friday will be 7800

-- Bullish above, with first resistance at 7840.

-- Bearish below it, first support is at 7740.

Wednesday, September 25, 2019

NQ Guideline For Thursday

-- NQ daily Trend = Down

-- NQ 60-minute trend = Up but now at strong resistance

-- NQ 5-minute trend = Up

NQ sold off hard soon after the open on Wednesday but massive intervention by the Fed eventually stopped the decline and the managed to push NQ up above key line-in-the-sand, which then triggered short-covering, caused a big rally.

NQ close just below strong résistance, 7840-7850 price zone, but above strong support 7800. Thus 7800-7850 will be a balance zone, and a breakout of the 7800-7850 price range could trigger a trending move out of the range.

Tuesday, September 24, 2019

NQ Guideline For Wednesday

-- NQ daily trend is now down

-- NQ 60-minute trend is also down, bit in oversold condition

-- NQ 5-minute trend is also down

A large down day for NQ on Tuesday with NQ breaking below 7800 key support, triggering massive algos selling with NQ down about 200 points from the early morning high.

With the 60-minute timeframe in oversold on Tuesday we could see oversold bounce and consolidation on Wednesday, but it will depends on where NQ trades in relation to its key inflection level.

Key intraday price inflection level for NQ on Wednesday will be 7740.

-- Trading above 7740 indicates likely consolidation as the shorts may be forced to cover. If so, the next resistance is again at 7800.

-- There will be more selling if NQ is not able to stay above 7740. Next support is 7650, then 7600

Trump spoke at the UN on Tuesday

Monday, September 23, 2019

NQ Guideline For Tuesday

-- NQ Daily Trend is still up but now as inflection price zone.

-- NQ 60-minute rend is down but now a5t critical support.

-- NQ 5-minute trend is down

NQ traded sideways inside a narrow trading range on Monday, still holding above critical support at 7800, a price level that needs to hold. Key resistance is at 7870

A break below 7800 is likely to trigger heavy selling by the daily algos with potential support a 7750

A break above 7870 could trigger some short-covering rally.

Sunday, September 22, 2019

NQ Guideline For Monday

-- NQ daily trend = still Up

-- NQ 60-minute trend is now Down

-- NQ 5-minute trend is Down.

NQ traded down to strong support, 7800, on Friday before bouncing, but then closed near the low. Depending on the 5-minute oversold bounce

Key inflection price level for NQ on Monday will be 7870.

-- Resistance is at 7910

-- Support is at 7800

A break below 7800 could trigger a lot of algorithm selling on the 60-minute and the daily timeframe, and could tank it down hard.

Thursday, September 19, 2019

NQ Guideline For Friday

-- NQ Daily Trend = Up

-- NQ 60-minute Trend = Turning Up

-- NQ 5-minute Trend = Turning Up

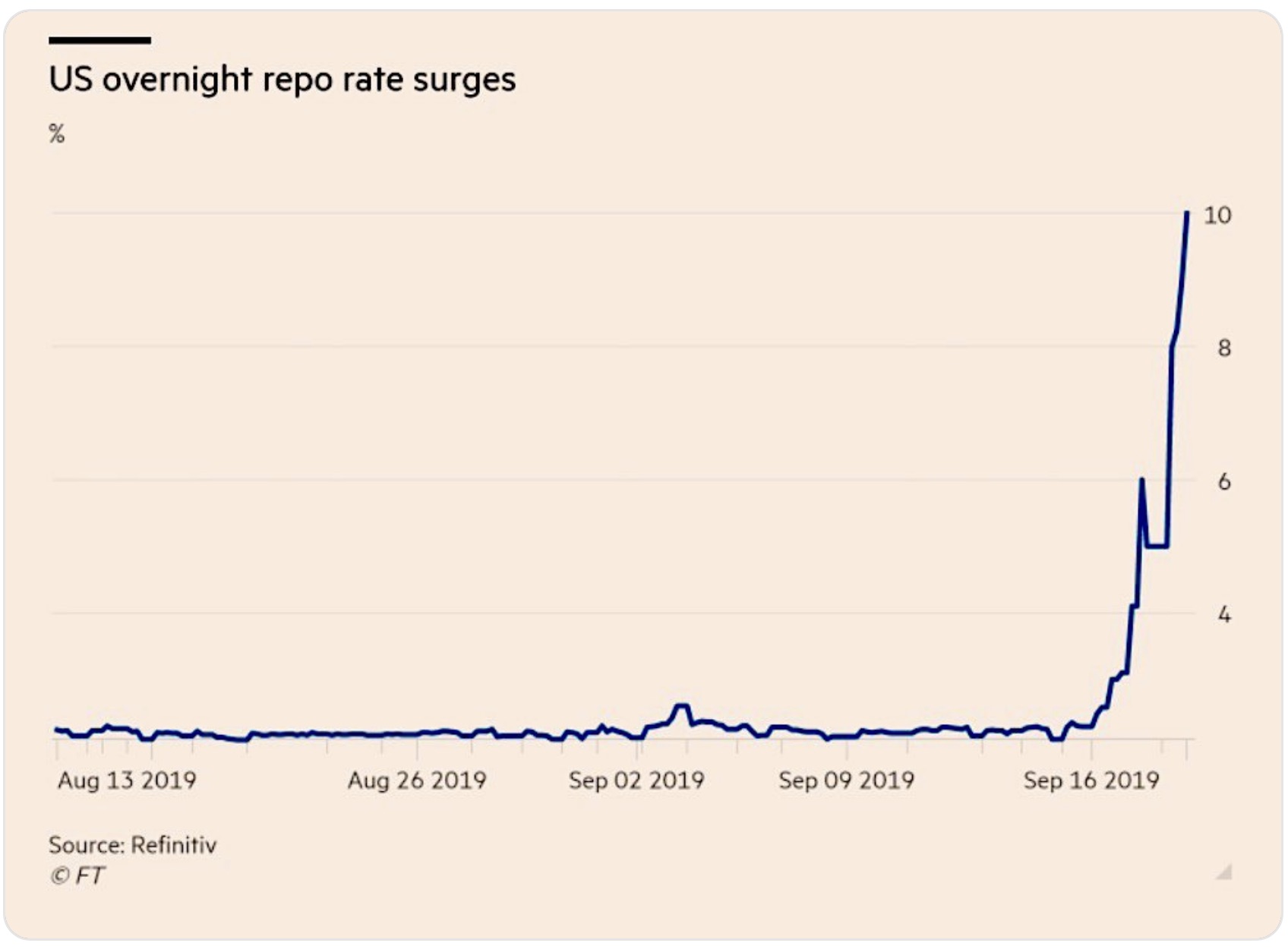

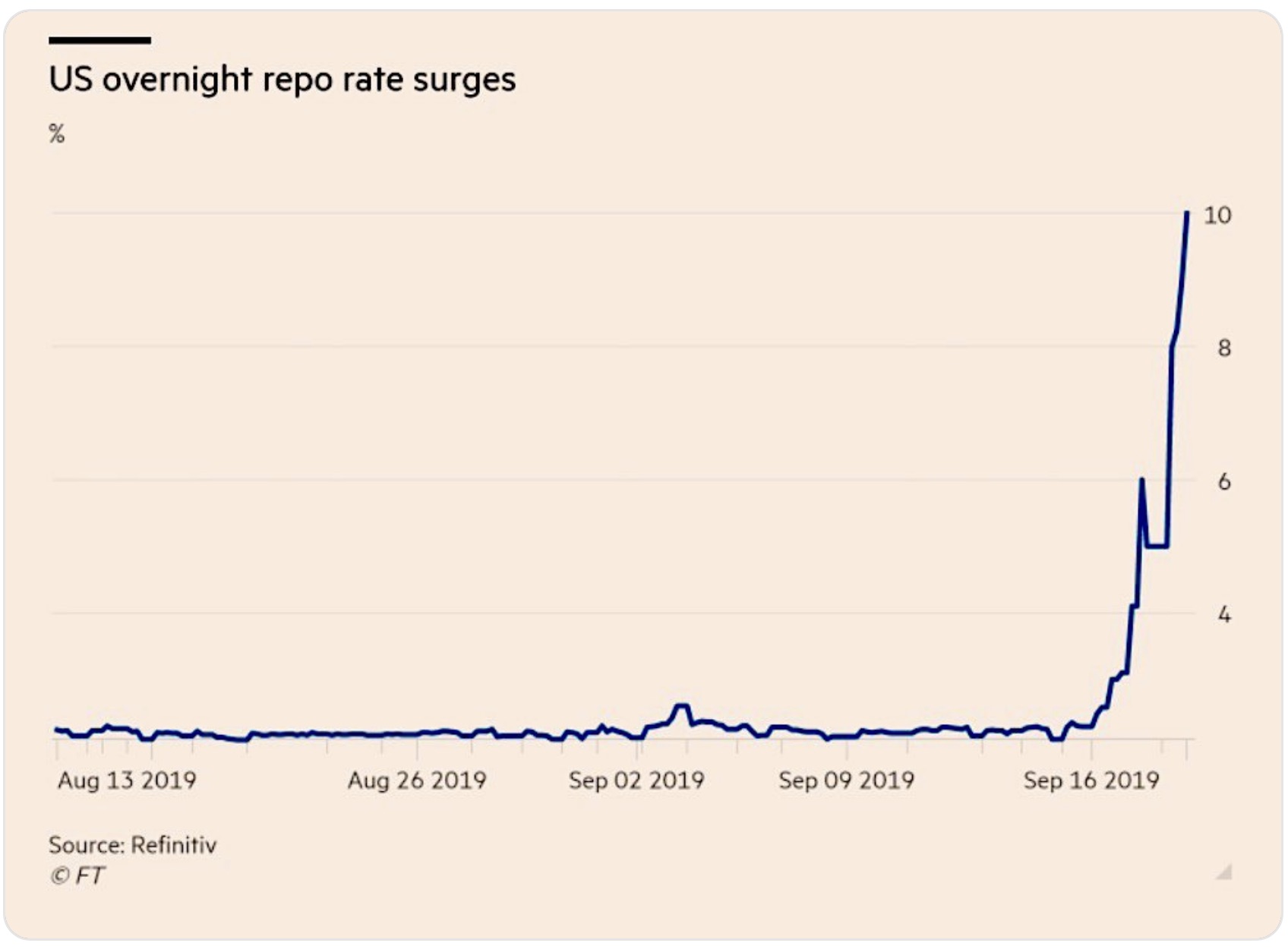

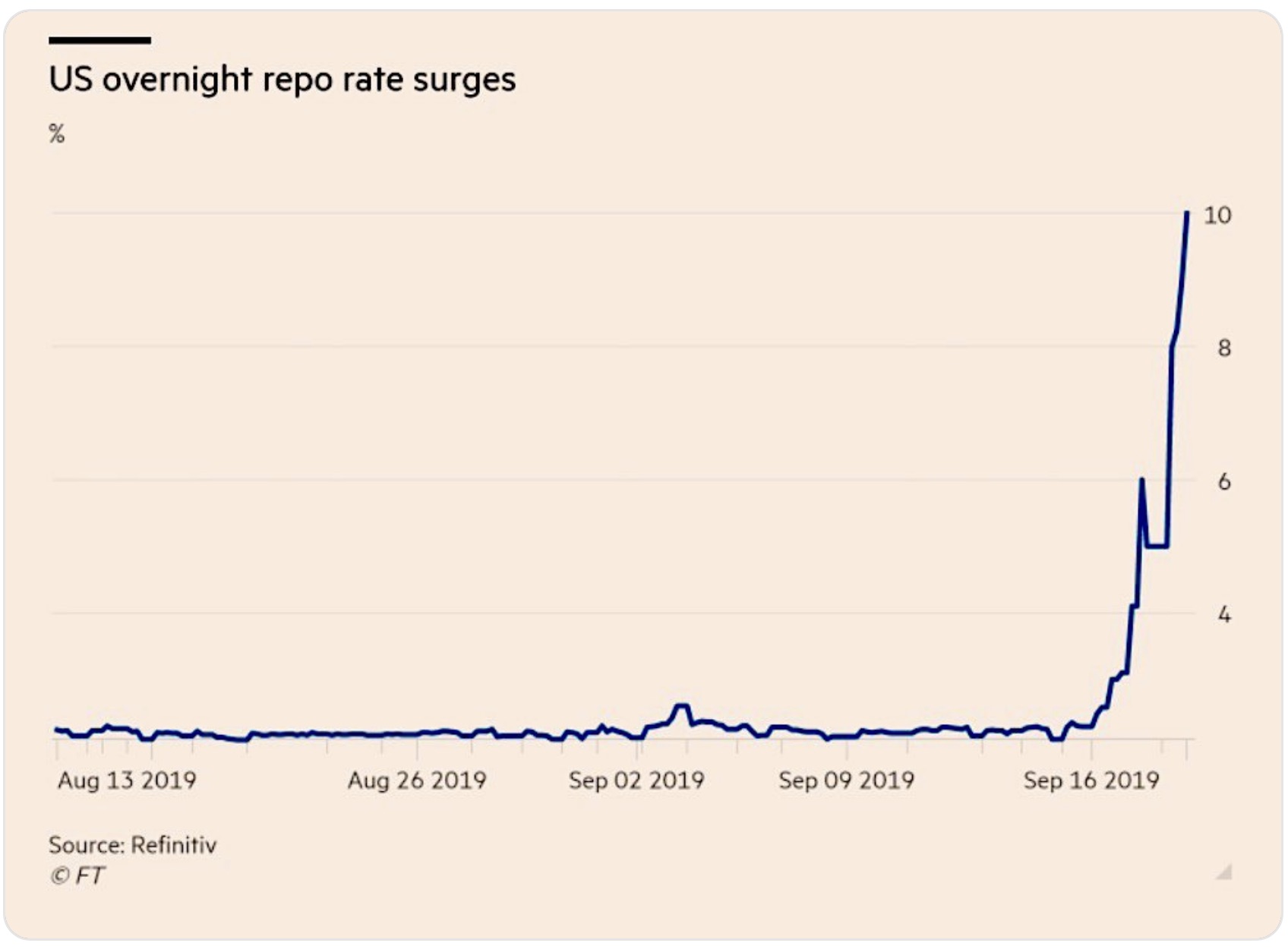

The market was engineered higher overnight on Wednesday night to keep it from crashing. Credit market crash for the third night in a row, the third consecutive night of intervention by the Federal Reserve, again injecting massive liquidity into the financial system.

Friday tends to be choppy, but key inflection price level for NQ on Friday will be 7940.

-- Bullish above it .

-- Bearish below it

Wednesday night was the 3rd night in a row that repo rate sky-rocketed that the Fed was again forced to intervene.

Wednesday, September 18, 2019

NQ Guideline For Thursday

-- NQ Daily Trend = Up

-- NQ 60-minute Trend = Turning Up

-- NQ 5-minute Trend = Turning Up

NQ was bearish all day on Wednesday, tanked after the FOMC decision was announced, then was rescued by the Fed knowing fully well that they will get bad tweets from Donald Trump

Still Donald Trump was harsh, calling the Fed "No Guts, No Sense, No Vision"

Key intraday Line-in-the-sand for NQ on Thursday will be 7880.

-- Bullish above

-- Bearish below it.

There is something really wrong in the financial market that could cause a big stock market crash.

Tuesday, September 17, 2019

NQ Guideline For Wednesday (December contract)

-- NQ daily trend = Up

-- NQ 60-minute trend = Up

-- NQ 5-minute trend = Up

NQ traded sideways in a very narrow range on Tuesday, but exploded into the close, setting up a rally day on Wednesday. Thus, as long as there is no negative new overnight, we should have a rally day on Wednesday.

Key price level for NQ on Wednesday is 7890.

-- If NQ should trade above 7890 on Wednesday we should see a sharp rally as shorts are forced to cover.

-- Negative news that cause NQ to open or trade below 7890 could cause some selling

Monday, September 16, 2019

NQ Guideline For Tuesday

-- NQ daily trend = Up

-- NQ 60-minute trend = Down, and in minor oversold condition

-- NQ 5-minute trend = Down

NQ pullback down-move that started from the high on Thursday last week continued on Monday with NQ closing at just above intraday inflection price level for Tuesday, 7870.

NQ could go either way in the morning on Tuesday depending on where it opens in relation to its intraday inflection level, 7870.

-- Opening above 7870 is an indication NQ want to run up to test its 200-ma on the 5-minute chart.

-- Opening below 7870 is an indi9cation that NQ may want to drop lower down to 7800 support before rallying back up.

With the FOMC meeting scheduled for next week, the Fed is going to continue to support the stock market and will buy any decline.

Sunday, September 15, 2019

NQ Guideline For Monday (September Contract Price level)

-- NQ daily trend = up but in minor overbought zone

-- NQ 60-minute trend = Up

-- NQ 5-minute trend = down

From August 23rd swing low NQ has rallied up in 5-wave pattern with the September 12th swing high. A decline on Thursday and Friday last week is indicating a possible end of the 5-wave rally.

A break below 7840 is the first indication that the 5-wave rally has in fact ended. If so look for NQ to drop lower towards supports, first support is at 7750.

Key intraday price level for NQ on Monday will be 7890.

-- Bullish above, target a retest of the high

-- Bearish below, next support is 7840-7850 zone

Thursday, September 12, 2019

NQ Guideline For Friday

-- NQ daily trend - UP

-- NQ 60-minute trend = Up

-- NQ 5-minute trend = Up

Insiders continue to take advantage of the Fed/PPT engineered rally to download their stock portfolio. On Thursday a huge gap-up open failed to attract buyer. NQ simply traded sideways.

Friday tends to be a choppy type of day. As such we can look for the market to continue to trade sideways unless the Fed/PPT overnight buy programs can push the stock market higher and trigger some short-covering after the open.

.Intraday inflection price level for NQ on Friday will be 7950, with support at 7990.

Wednesday, September 11, 2019

NQ Guideline For Thursday

-- NQ daily trend - UP

-- NQ 60-minute trend = Up

-- NQ 5-minute trend = Up

NQ opened above 200-ma on the 5-minute chart on Wednesday, triggered short-covering, with NQ closing at the day high.

Key line-in-the-sand on Thursday will be 7885.

-- Bullish above it. Trump buy programs is already running full gear overnight after he announced a delay in new tariff, may cause a big gap-up open on Thursday. If so, the open should serve as a new LIS after the market open.

-- If NQ should open below 7885 (not very likely) that is bearish.

Tuesday, September 10, 2019

NQ Guideline For Wednesday

-- NQ Daily trend = Up

-- NQ 60-minute trend = Down

-- NQ 5-minute trend = Down

NQ opened with a gap-down below support on Tuesday then after sold off right away down to support, then spent the rest of the day trading sideways, closing right below 200-ma on the 5-minute chart.

Key price level for NQ going into Wednesday will be 7840 active as resistance now.

-- Trading below 7840 is going to attract sellers, with support at 7750, 7720 , 7650

-- If NQ should trade above 7840 we could see some short-covering rally.

Trump fired his National Security Advisor, John Bolton

-- NQ 60-minute trend = Down

-- NQ 5-minute trend = Down

NQ opened with a gap-down below support on Tuesday then after sold off right away down to support, then spent the rest of the day trading sideways, closing right below 200-ma on the 5-minute chart.

Key price level for NQ going into Wednesday will be 7840 active as resistance now.

-- Trading below 7840 is going to attract sellers, with support at 7750, 7720 , 7650

-- If NQ should trade above 7840 we could see some short-covering rally.

Trump fired his National Security Advisor, John Bolton

Monday, September 9, 2019

NQ Guideline For Tuesday

-- NQ daily trend = Up

-- NQ 60-minute trend = Down

-- NQ 5-minute trend = Down

A pullback-down day for NQ on Monday. After trading sideways in the morning NQ dropped down below range low support 7840 which ran over some trailing stop-loss and tanked NQ quickly down to7800 support.

7800 support held on Monday, then after trading sideways above 7800 for a while, end of day profit-taking push NQ up to close just below broken support 7840 but now it will act as key resistance for NQ on Tuesday.

After over two days of consolidation following a large up day on Thursday, NQ may try to rally on Tuesday. For the rally to gain traction NQ would have to clearly break above 7840 to trigger some short-covering to help with the rally.

Failure to break-back above 7840 is going to attract selling, if so supports are again 7800, 7770 and 7720

Looks like gold is being manipulated down ahead of the FOMC meeting this month where the Fed, under intense pressure from President Trump, is highly expected to cut short term interest rate.

Sunday, September 8, 2019

NQ Guideline For Monday

-- NQ daily trend = Up

-- NQ 60-min trend = Up but overbought.

-- NQ 5-min trend = Up

NQ continued to consolidate on Friday, the second consolidation day in a row, thus may be ready to move out of the current range between 7840 support and 7880 resistance.

Inflection price level for NQ on Monday will be 7870

-- Bullish above it but NQ would need a sustained break above 7880 to trigger some more buying/short-covering to cause a large rally day.

-- Bearish below it, but NQ needs a sustained break below 7840 to run over trailing stop loss and tank. There are several support levels that could stall the decline, 7800, 7770, 7750, but strong support is at 7670.

Thursday, September 5, 2019

NQ Guideline For Friday

-- NQ Daily rend = Up

-- NQ 60-minute trend = Up and in overbought zone

-- NQ 5-minute trend = Up

Buy programs started on Wednesday night during low volume globex trading session when it is much easier to manipulate the market. Buy programs then continued on all day on Thursday, however, NQ only managed to rally during the first trading hour on Thursday morning as distribution selling by large funds kept the rally from continuing on after just the first hour of trading on Thursday.

For Friday, as long as NQ remains above 7840 we could see more rally in the morning before pulling back down or just trade sideways. However, should NQ opens below 7840 we could see morning pullback down move before rallying back up.

The excuse used by the Fed/PPT to trigger buy programs on Wednesday night and into Thursday was trade talk with China.

Wednesday, September 4, 2019

NQ Guideline For Thursday

-- NQ Daily Trend = still in consolidation mode

-- NQ 60-minute trend = up but approaching strong resistances

-- NQ 5-minute trend = up & in overbought condition

Global central banks continue to lower short term interest rate and buying bonds to push long term interest rates down to negative in many places, buying stocks to keep the stock market up, but this time the impact is likely to be very short-lived.

Prices of precious metals including gold and silver (the real money), are rocketing up, indicating the beginning of a synchronized global currency collapse, some currencies collapsing faster than others, example the Venezuelan Bolivar, Argentinian Peso, Australian Dollar, British Pound, just to name a few. Stock market collapse will come next and very soon, then followed by the bond market collapse.

A huge gap-up open in the stock market on Wednesday failed to trigger a big rally as funds continued to take advantage of the rally to download their long position.

On the short term intraday timeframe, key inflection price level for NQ on Thursday will be 7710.

-- Trading below 7710 indicates NQ is going into a pullback down m,ode, support is at 7650

-- Trading above 7710 in the morning indicates NQ is going to rally higher before pulling back down, first resistance is 7760 then 7800

Tuesday, September 3, 2019

NQ Guideline For Wednesday

-- NQ daily trend = in consolidation mode

-- NQ 60-minute trend = down

-- NQ 5-minute trend = down

NQ daily trend is in consolidation mode, as such NQ traded sideways on Tuesday, between support and resistance.

On Wednesday support will be at 7590 and resistance at 7650.

-- A sustained break out of the range could trigger strong trending move

Monday, September 2, 2019

NQ Guideline For Tuesday

-- NQ Daily trend = in consolidation mode

-- NQ 60-minute trend = down

-- NQ 5-minute trend = down

NQ is now stucked between 50-dma (7760) resistance and 20-dma (7610) support on the daily chart. Until we get a clear break out of the range, NQ is going to stay choppy, but a breakout should happen soon. If so, lower support is 7500.

Key intraday inflection price level for NQ on Tuesday is 7675

-- Bearish below it, with first support is again at 7550.

-- Bullish above it, with first resistance is 7750

Subscribe to:

Comments (Atom)