Thursday, January 31, 2019

NQ Guideline For Fridaay

NQ again rallied on Thursday as the shorts continued to cover. With NQ daily chart just starting to enter overbought territory we could still see NQ continuing to rally to its key 200-dma before pulling back down.

On the intraday 5-minute chart however, NQ entered a pullback consolidation mode in the afternoon on Thursday. Unless NQ can clearly breakout and stay above Thursday swing high we could see NQ pulling back down towards its 200-ma on the 5-minute chart, with downside target of between 6820-6840.

Key intraday line-in-the-sand for NQ on Thursday will be Thursday swing high of 6945.

Wednesday, January 30, 2019

NQ Guideline For Thursday

After breaking above its 50-day moving average on the daily chart, then spent seven consecutive day consolidating sideways just above its 50-dma and 20-dma on the daily chart, NQ finally found an excuse to rocket up following the FOMC extreme dovish statement on Wednesday.

The shorts are finally starting to cover. With NQ now not yet in overbought territory on the daily chart, NQ should continue to rally, with or without consolidation , next target is its 200-day moving average, now sitting at 7100..

On the intraday 5-min chart, NQ should continue to rally without consolidation as long as it continues to trade above its 50-period moving average. A break back below 50-ma implies consolidation.

Tuesday, January 29, 2019

NQ Guideline For Wednesday

On Tuesday NQ opened where it closed on Monday, in bearish territory on the intraday 5-minute chart. Sellers came to sell NQ down to below prior day low, to support before trading sideways for the rest of the day.

Earning reports from AAPL gave some big buyers some excuse to push Apple shares price higher after the close, dragging NQ up with it..

Key intraday line-in-she-sand for NQ on Wednesday will be at 6700.

-- Overnight NQ is still trading below 6700. It has to break above 6700 to get to the bullish mode on the 5-minute chart, and trigger some intraday buying activities .

-- NQ will remain is sell mode on intraday 5-minute chart below 6700. Support is at 6600

On the daily chart, NQ is still bullish, but on the 60-minute chart and the 5-minute chart, NQ is still in a pullback down mode.

AAPL reported its earnings on Tuesday, more earning to come this week, plus the FOMC is going to announce their policy decision on Wednesday, any of those can move the market up or down.

Monday, January 28, 2019

NQ Guideline For Tuesday

On Monday, NQ opened with a huge gap-down, then after dropping down early in the morning, traded sideway for the rest of the day, remained below broken support, now resistance, the 200-period moving average on the 5-minute chart, now at 6725 as of Monday's closing price..

Key intraday line-in-the-sand for Tuesday will be the 200-ma on the 5-minute chart, 6725.

-- If NQ should gap-up above 6725, we could see a rally in the morning followed by a sideways trading action..

-- Should NQ opened below Monday's swing low, we could see a sell-off in the morning, with the next support at 6600-6620 price zone.

As usual, earning reports could cause unexpected price moves.

Sunday, January 27, 2019

NQ Guideline For Monday

NQ is bullish on the daily chart and the 60-minute chart, but as of Friday's closing NQ is in a consolidation mode on the 5-minute chart.

On the 5-minute chart, NQ may not have completed its consolidation pattern. If so, NQ would either continue to trade sideways or drop down further to support, the 200-moving average, before it continues to rally again, that is as long any pullback down move does not break below key support, the 200 ma.

On the other hand, if the 5-minute chart consolidation has ended, NQ should rally in the morning to the next upside target of between 6850-6900 before pulling back down.

Heavy earning reports begins on Monday, with many S&P 500 companies reporting their Q4 2018 earning, thus we could see some unexpected big moves, up or down.

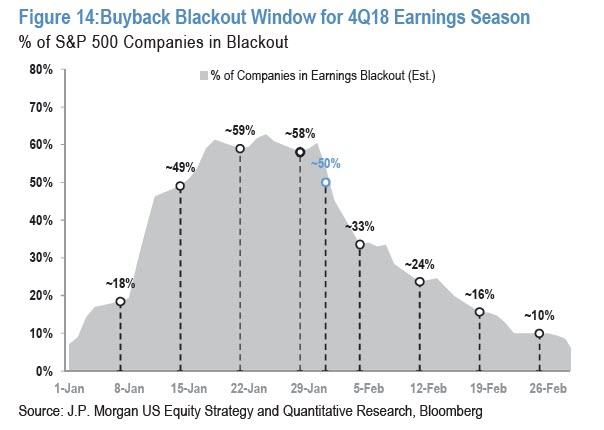

The coming week will also see majority of the S&P 500 companies prevented from buying back their shares (see chart below), thus any big sell-off could get ugly quickly because so many companies would not be able to rescue the market by buying their own shares.

.

Thursday, January 24, 2019

NQ Guideline For Friday

Thursday was a very narrow-range sideways consolidation type of day for NQ. It was stuck between bullish mode on the daily chart, bearish mode on the 60-minute chart, and bullish mode on the intraday 5-minute chart.

Thus, key price level for NQ on Friday will be 6670 support and 6710 resistance.

-- A break above 6710 could potentially trigger a short-covering rally, with the next upside target at 6800.

-- Trading below 6670 is likely to trigger fast liquidation with potential support at 6570

-- With Friday tendency toward a choppy type of day, also be on a lookout for breakout reversal, as NQ may break out of the 6670-6710 trading range and then reverse sharply.

Wednesday, January 23, 2019

NQ Guideline For Thursday

As expected, following a trending down day on Tuesday NQ traded sideways in a consolidation pattern, trading between resistance and support.

NQ rallied up to resistance in the morning then dropped down to just below support during lunch time, then rallied back up towards resistance in the afternoon a typical non-trending type of day pattern. A consolidation day is a setup for a trending move.

However, with the longer timeframe, the daily chart still in bullish mode fighting against the shorter term timeframes, the 60-min chart and the 5-minute chart currently in bearish mode, we could see a trending move, up or down in the morning, get reversed in the afternoon, simply because we have a mixed signals, a fight between the longer term daily timeframe and the short-term timeframes.

Key line-in-the-sand for NQ on Thursday will be 6690.

-- Bearish below it, selling could push NQ down to around 6580 support before it reverse (as long as the overall market does not get too bearish)

-- Bullish above it, short-covering and buying could catapult NQ up to 6800 resistance before profit-taking push it back down.

Tuesday, January 22, 2019

NQ Guideline For Wednesday

Last week Fridays high was a 50% retracement level of the entire decline from October high to December low. The 50% retracement level is a very popular level for many algos to enter their trade.

Sellers came on Friday, then selling continued on Tuesday. A break below Friday low triggered heavy selling that lasted most of the day with the typical end of day profit-taking near the close.

Key intraday price level for NQ on Wednesday will be Tuesday swing low, 6610.

-- Trading above Tuesday swing low of 6610 should keep selling under control. If so, we could see a sideways consolidation type of day on Wednesday, with support at 6610 and resistance at 6735.

-- Should NQ trade below 6610 we could see another round of selling. If so, supports are at 6525 then 6475.

Monday, January 21, 2019

NQ Guideline For Tuesday

NQ is still in an uptrend (bullish mode) on the daily chart, and still in an uptrend (bullish mode) on the 60-minute chart, but in a pullback consolidation mode on the intraday 5-minute chart at the close on Friday..

With all the major indices, the NQ, the S&P 500 and the Dow all currently above their respective 20 and 50-dma (thus in bullish mode), but still below its key 200-dma resistance, there is still a lot of room left for the market to rally. NQ is currently still about 300 points below its 200-dma (7100) as of Friday's closing price (on the daily chart).

On the short term intraday time frame, key support for NQ on Tuesday will be at 6735.

-- As long as any pullback decline in NQ remains above 6735, the rally will continue, with the next upside target above Friday's swing high.

-- Should NQ decline and then clearly break below 6735, we could see more selling, if so, strong support is currently at 6650

,

Thursday, January 17, 2019

NQ Guideline For Friday

NQ opened and dropped briefly just below key support level on Thursday. It did not trigger enough selling programs to overwhelm the PPT buying power. The buy programs quickly rally NQ back up above support thus aborted any possible selloff.

Without buyers, NQ continued to traded sideways all day until another buy programs hit the market in the afternoon, when was again got pushed back down immediately.

On Friday, with most traders out of the market for the long weekend, the Martin Luther King Jr day, we could see a rally, if the PPT buy programs is active, or trade sideways if they are not active.

Key support for NQ on Friday will be 6690.

-- As long as NQ remains trading above 6690, selling would remains under control. If so, we can see another higher high above Thursday high before profit-taking can push NQ back down.

-- Should NQ break back down below 6690 we could see some sharp selling

Wednesday, January 16, 2019

NQ Guideline For Thursday

NQ continued to rally into another higher high on Wednesday morning. However, after the initial early morning rally profit-taking pushed NQ down to close below Tuesday closing price.

On the 60-min chart, it is very obvious that NQ has rallied in a 5-wave pattern from December 24th low to Wednesday high, with Tuesday and Wednesday rally as wave 5 up. . Once the 5-wave rally is complete, NQ should then decline.

The first support level to break to indicate that wave 5 rally may have ended is the 20-period moving average on the 60-min chart, then a clear break below its 50-moving average on the 60-min chart confirms that the 5-wave rally has ended, and a retracement decline has started.

For Thursday that key support level is 6660.

-- Trading below 6660 is bearish, the next support is 6600. A break below 6600 could trigger heavy selling as trailing stop-posses gets run-over.

-- Trading above 6660 will keep selling under control, but it has to break back above 6690 to get back to bullish bias and trigger a rally to another higher high.

Tuesday, January 15, 2019

NQ Guideline For Wednesday

A breakout day for NQ on Tuesday, with NQ opening above prior day high, triggering buy programs and rallied, a large up day for NQ on Tuesday.

With NQ upside target reached in the morning NQ then traded sideways the rest of the day, consolidating the big morning rally. If consolidation is complete, NQ should then rally again or reverse back down.

Key inflection price level for NQ on Wednesday will be 6670.

-- Bullish above 6670, an indication the rally has resumed.

-- Trading below 6670 implies NQ is either going to trade continue to trade sideways, or reverse back down. Key support on any decline will be 6610, the 200-movign average on the 5-min chart.

Monday, January 14, 2019

NQ Guideline For Tuesday

NQ again traded sideways in a narrow trading range on Monday, the fourth day in a row, without buyers except the PPT, has not been able to mount a rally through strong resistance.

At the same time, there is not many sellers either, until it has decline down far enough to run-over trailing stop-losses and also triggers selling algos, thus until then, it can continue to trade in a narrow trading range.

Monday's trading range, 6520 low and 6580 high, looks good to catapult a breakout to trigger a large trending move out of the range.

Inflection price level for NQ on Tuesday will be 6555

-- Bullish bias above 6555, but key resistance is at 6580. A sustained break above 6580 has the potential to trigger a large trending move up. If so the next resistance is at 6670-6700

-- Bearish bias below 6555, with key support at 6520. A sustained break below 6520 has the potential to trigger a large trending move down. If so the next support is at 6400

Sunday, January 13, 2019

NQ Guideline For Monday

NQ traded sideways in a very narrow range on Friday, trading below key resistance for the third day in a row, unable to break above it. Unless it can clearly break above 6700 and trigger short-covering, NQ may need to drop back down.

As long as the decline does not get out of control, it may then rally back up to try to break above key resistance on the daily chart, the 50-day moving average for NQ.

Key intraday inflection price level for NQ on Monday will be 6600.

-- Trading below 6600 is bearish, potential supports are 6500 then 6450.

-- Trading above 6600 is bullish, next resistance is 6700.

Thursday, January 10, 2019

NQ Guideline For Friday

The Fed Chairman very dovish speech at the Economic Club on Thursday might have saved the stock market from being sold-off again. Aggressive buying by the Fed/PPT right at the open helped pushed NQ up from a huge opening gap-down on Thursday.

With the PPT certain to continue buying the stock market, they may be able to push NQ above key resistance, the 50-dma on the daily chart. A clear and sustained break could trigger algos buying that could cause a huge 200 to 300 point rally.

Key inflection price level for NQ on Friday will be 6620, acting as resistance at the close on Thursday. Should NQ opened above 6620 on Friday, 6620 will act as support, and the next major resistance is 6700.

Wednesday, January 9, 2019

NQ Guideline For Thursday

Another narrow range up day for NQ on Wednesday as it continue to rally into major resistance at 6700, the 50-dma on the daily chart and also at trend-line resistance. As such, we could see heavy selling on Thursday and into Friday morning.

Key inflection price zone for NQ on Thursday will be at 6620.

-- Trading below 6620 is going to trigger some selling activities, with first target at 6560.

-- Should 6560 get violated to the downside, we could see another round of selling, with lower support at 6460.

-- Strong support is not until 6400

-- Trading above 6620 is bullish with the next resistance at 6700, the 50-dma on the daily chart and also at trend-line resistance.

U.S. President Donald Trump stalked out of a meeting with congressional leaders Wednesday as efforts to end the almost 19-day partial government shutdown fell into deeper disarray over his demand for billions of dollars to build a wall on the U.S.-Mexico border

Tuesday, January 8, 2019

NQ Guideline For Wednesday

Another narrow range choppy sideways trading pattern for NQ on Tuesday, with a gap-up opening followed by a drop down to support before rallying back up again

Currently, NQ is still in short term bullish mode above 6460. However, it is now bumping up into several resistances thus the slow rally

Intraday inflection price level for NQ on Wednesday will be 6540.

-- NQ is in a bullish mode above 6540, with the next target will be a rally to above Tuesday high.

-- Trading below 6540 implies NQ is going to drop down to support at 6460 price zone before rally back up again, that is, a long as 6460 is not clearly violated.

Monday, January 7, 2019

NQ Guideline For Tuesday

A narrow range up day for NQ on Monday following a very large up day last Friday.

With President Trump's trade negotiation team now in talk with the Chinese, look for the PPT to remains very active in pushing the stop market up for Trump so that he can claim victory regardless of what would come out of the talk.

As such, look for the stock market to continue to go up, that is, as long as pullbacks down move do not get too much out of control.

On the short term 5-minute timeframe, key inflection price level for NQ going into Tuesday trading is 6510.

-- If NQ should trade below 6510 on Tuesday, look for NQ to trade down to supports before going back up again. First support is 6460, then 6420..

-- If NQ should open above 6510 and stay above 6510, look for the rally to continue, with the next resistance at 6559 then 6650.

Sunday, January 6, 2019

NQ Guideline For Monday

A big rally in the stock market as the PPT continue to aggressively push the stock market up. NQ rallied up to strong resistance , the 20-day moving average on the daily chart on Friday and stalled at that level, setting up either a pullback down move on Monday, or a continuing rally on Monday, depending on where it trades in relation to the 20-dma on the daily chart, which was at 5460 as of Friday's close.

Thus, key price level for NQ on Monday will be 6460, acting as resistance as of Friday's close.

-- Bullish above 6460 with the next resistance at 6500 prior swing low, then 6625, then 6700. Any of these resistances can send NQ dropping back down.

-- Below 6460 implies NQ is going does to supports before going back up, that is, as long as support holds. Key support is 6300.

The democratic-controlled congress is determine to impeach President Trump, and that is bad for the stock market

Thursday, January 3, 2019

NQ Guideline For Friday

The PPT were able to push the stock market futures up on Wednesday night to ensure the market open inside prior day range, in order to avoid a crash scenario if the market was allowed to open below prior day low on Thursday.

NQ traded sideways on Thursday with NQ closing at the low of the day, setting up a gap-down open below prior day low ad then trend down, unless they can again push the futures market up during low volume overnight trading hours.

Key inflection price level for NQ on Friday will be 6200.

-- Trading above 6200 could trigger a rally to 6300 resistance where selling can again overwhelm buying. If for some reason the PPT can push NQ up above 6300 we may see further rally.

-- Trading below 6200 is bearish and could attract heavy selling activities capable of overwhelming the buyers.

Wednesday, January 2, 2019

NQ Guideline For Thursday

On Wednesday NQ opened with a huge gap-down but then rallied sharply until the end of day profit-taking tanked the market down to closed somewhere in the mid-range.

After the close, Apple announced a disappointing earning that tanked the market hard in overnight trading, setting up a potential selloff day on Thursday.

Key price level to watch on Thursday will be 6200.

-- Trading below 6200 could run over trailing stop loss for the bulls and triggering a cascade of sell orders, potentially tanking the market.

-- Opening above Wednesday swing low could cause a morning rally. First resistance where sellers could come in large numbers will be around 6330.

Tuesday, January 1, 2019

NQ Guideline For Wednesday

With most traders and algos out of the market on Monday, new year eve trading was choppy, sideways, narrow range and low volume. On Wednesday, the stock market may be coming back to normal as many traders will be back to work.

With NQ still trading below its 20-day moving average on the daily chart, at around 6550 as of Monday's closing, most daily algos will not be active until NQ has rallied back up to 6550 on Wednesday. As such, it will be left to the shorter-term algos to continue the rally or trend back down again.

Key intraday price level for NQ on Wednesday will be 6300, acting as support as of Monday's closing price.

-- If NQ remains above 6300 on Wednesday, short term intraday algos will be buying. If so the next upside target is 6500 to 6550 resistance.

-- Trading back below 6300 could trigger selling, first support is at 6250. A clear break below 6250 could attract an avalanche of selling, and lower supports are at 6160-6180. Should those level get violated we could see another free-fall scenario.

Subscribe to:

Comments (Atom)