Sunday, December 30, 2018

NQ Guideline For Monday

NQ traded sideways on Friday as most traders were out of their office for the end of the year holiday.

Monday is December 31 2018, the last trading day for the year. With most traders on holidays, it is likely going to be a very light trading volume day.

As such, there could be a lot of shenanigans going on. On one side is the PPT who would love to see a thousand point rally in the Dow going into the end of the year just to make President Trump looks good.

On the other side, there could be a lot of deflationary selling that could easily overwhelm the PPT buying activities and tank the stock market.

If, however, none of the above happens, the stock market could just trade sideways in a narrow trading range simply because there are not too many traders still trading on new yers eve.

Key NQ support on Monday will be 6230.

-- Trading below 6230 could trigger some selling with the next lower support at 6160-6180. NQ would need to clearly break below 6160 to trigger liquidation margin selling.

-- If NQ remain above 6230 on any decline it could then rally back up to perhaps another higher high as selling would be under control..

Thursday, December 27, 2018

NQ Guideline For Friday

Following a huge rally day on Wednesday the stock market traded sideways on Thursday, with NQ closing just slightly above Wednesday swing high.

On Thursday, the stock market sold off hard in the morning and into early afternoon until the PPT intervene aggressively to push the stock market up.

With just a few days left for the year 2018, the PPT is certain to remains very aggressive in stock purchases. The last thing president Donald Trump would want to see is a stock market that is down for the year.

For Friday, the PPT is going to continue to buy any decline. Thus, unless NQ clearly break below Thursday swing low of 6056 and overwhelm PPT buying power, NQ should either trade sideways or rally to a new higher high above Thursday high.

Wednesday, December 26, 2018

NQ Guideline For Thursday

Massive intervention by the plunge protection team, buying stocks across the board, rocketed the stock market higher on Wednesday, with NQ closing over 350 points from prior day close.

The PPT is certain to continue their stocks buying activities into the end of the year, in order to make thing looks good for Trump. On Wednesday President Trump went on national TV to tell people to buy stocks. Whether or not they can continue to rally the market higher, it is difficult to say.

For NQ key intraday support on Thursday will be 6160-6180.

-- NQ may pullback down to 6160-6180 support before continuing to rally to higher high. However, if 6160 does not hold on any pullback down move, a clear break below 6160 is an indication the forces of deflation is overwhelming the buying power of the PPT. If so, algos selling is going to tank the market again.

NQ Guideline For Wednesday

On a short trading day ahead of the Christmas day, the stock market tanked hard on Monday as deflationary forces continued to assert itself. Investors has started to panic as the fear gauge VIX rocketed on Monday, signaling a temporary bottom may not be too far away.

The plunge protection met in preparation for their market intervention as the stock market enters a potential free-fall scenario.

NQ tanked hard on Monday breaking below minor support at 6000. With the next strong support not until 5000 the stage is set for a real crash unless of course the PPT intervene aggressively to calm the nervous investors.

Key resistance price level for NQ on Wednesday will be 6000.

-- Trading below 6000 could trigger massive algorithm selling.

-- Staying above 6000 should keep selling under control.

Sunday, December 23, 2018

NQ Guideline For Monday

With Monday as a short trading day and likely a low volume day ahead of the Christmas holidays, the stock market may simply just trade sideways. However, it is the type of day when crashes can happens.

Key price level for NQ on Monday will be 6180, now active as key resistance, and Friday's swing low as support.

Thursday, December 20, 2018

NQ Guideline For Friday

Another large down day for NQ on Thursday as traders and investors continued to get liquidated by the forces of deflation.

Going forward, if the stock market continue to sell-off, we have a high probability of a 1987 style crash as momentum algos continues to sell into decline.

Key price level for NQ on Friday is the Friday swing low of 6180.

-- Trading above 6180 should keep sellers under control until it has rallied up to resistances, 6320 and 6400.

-- Breaking back below Thursday low is an indication NQ is in crash mode, there is no more strong support until way down.;/

Wednesday, December 19, 2018

NQ Guideline For Thursday

The stock market tank hard after the FOMC policy decision was announced in the afternoon, Thursday was a large down day. With the Fed policy decision now out of the ways the market can now trend again

However, on the short term intraday time frame, following a large trend day the market tends to consolidate. If so we can see NQ trading sideways in a narrow range on Thursday.

Key price level to watch for on Thursday will be Wednesday swing low of 6300.

-- Trading below 6300 can trigger more selling especially margin selling. If so we can see stock market crash, although it does not usually occur on Thursday.

-- Trading above 6300 is going to keep selling under control and could trigger some profit-taking activities. If so the resistances where seller could come in are 5424-6440 then 6500.

Tuesday, December 18, 2018

NQ Guideline For Wednesday

NQ simply traded sideways on Tuesday in a narrow range inside of prior day range, an inside day ahead of the FOMC decision on Wednesday. An inside day is often a setup for strong trending breakout day.

Many investors may be waiting for the tone of the FOMC policy announcement on Wednesday afternoon before making their big decision. A very dovish tone could set up a multiday rally. A hawkish tone could trigger heavy selling

Key inflection price level for NQ on Wednesday will be 6520, with first resistance at 6560, and first support at 6460.

Monday, December 17, 2018

NQ Guideline For Tuesday

With the daily chart timeframe in sell mode and still not yet entering an oversold condition, morning rally on Monday attracted heavy selling at key line-in-the-sand resistance of 6660, overwhelming the short-term buyers.

As such, the decline resumed on Monday, with a small profit-taking bounce at the end of the days to created a large down day. Unless NQ can rally above key line-in-the-sand on Tuesday, selling should continue on Tuesday.

Key line-in-the-sand for NQ on Tuesday will be at around 6530.

-- Trading above 6530 is an indication NQ may be going into a sideways consolidation mode following a large down day on Monday. However, any rally would need to clearly break above 6530 to trigger short-covering. If so the next resistance where selling would come back in is at 6660.

-- NQ remaining below 6530 on Tuesday is an indication NQ downtrend is still in progress.

Whether or not the Fed/PPT would intervene in the stock market ahead of the FOMC decision on Wednesday it is difficult to forecast, thus we would just have to watch the key price levels.

Sunday, December 16, 2018

NQ Guideline For Monday (Price Level For March 2019 Contract)

On Friday NQ opened with a huge gap-down. Then after a brief morning rally up to resistance, the selloff continued, closing near the low, a large down day for NQ on Friday.

With the daily chart in sell mode, Monday is either a pullback consolidation day or a large sell-off day.

Key price level to watch for will be 6660.

-- Trading above 6660 could trigger some buying on the short term intraday timeframe. If so, there the resistances are 6690 and 6750.

-- Trading below 6660 is going to be bearish and could result in a large selloff day, especially if NQ trades below Friday low and triggers selling algos.

Thursday, December 13, 2018

NQ Guideline For Friday

NQ traded sideways in a narrow range on Thursday but traded mostly below key 200-ma on the 5-minute chart most of the day on Thursday and then closed below it.

Unless they can push NQ to open up above the 200-ma on the 5-minute chart which was 6779 at Thursday close, we could see a sharp and large decline on Friday

Trading back above 6779 on Friday could cause a sharp rally particularly if the short-sellers decides to cover, but strong resistance now resides at 6950

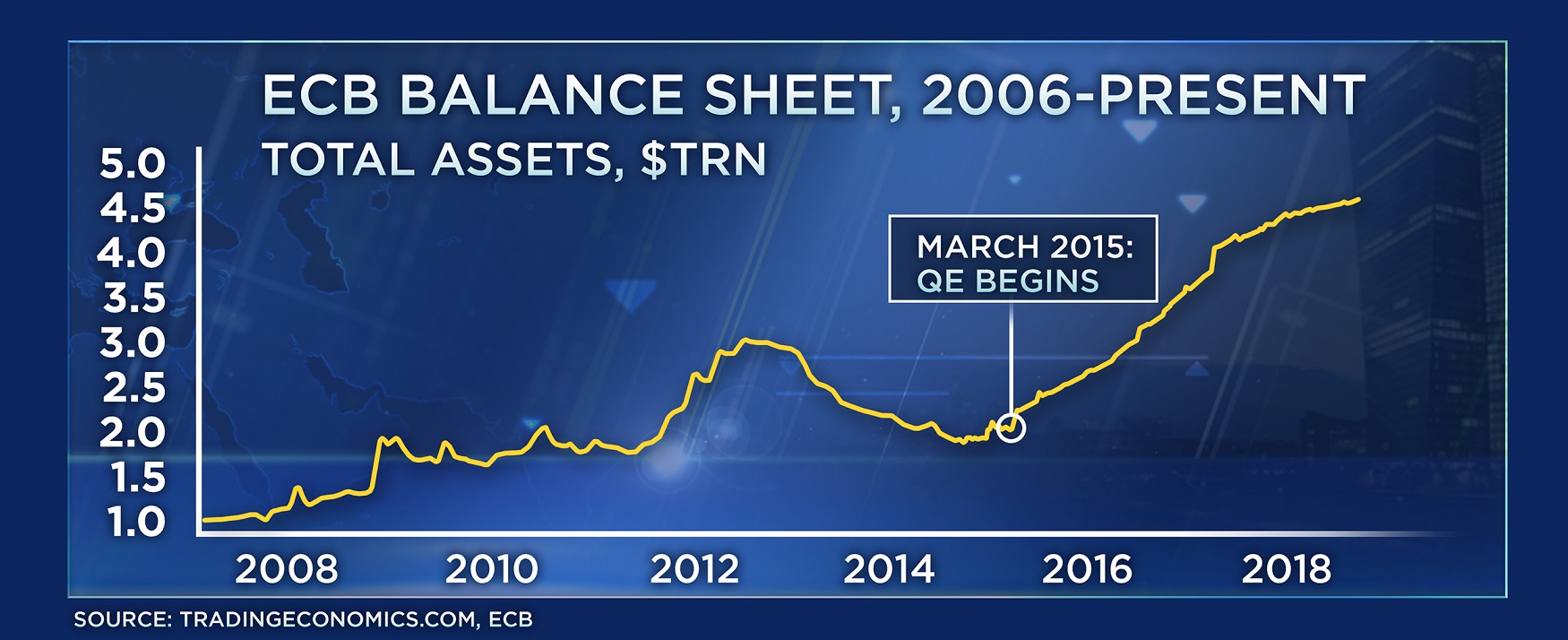

The ECB's governing council confirmed what policymakers had been saying since the summer. They will stop expanding quantitative easing (QE) from the end of December — when bond purchases will fall from 15 billion euros a month to zero.

Subscribe to:

Comments (Atom)