Thursday, September 29, 2016

NQ Guideline For Friday

The stock market sold off hard on Thursday ahead of the official inclusion of the Chinese Yuan into the SDR basket, and the official launching of the SDR world money as a world reserve currency to slowly replaces the USD. Central banks buy program managed to push the market back up to the middle of the day range for NQ.

The Fed Chairperson Janet Yellen has officially requested permission from Congress to openly and directly buy the stock market, instead of using proxy.

The battle between deflation and central banks is certain to continue until central banks eventually capitulates or until fiat paper money becomes worthless. Deflation is now starting to win. Deutsche Banks shares is fast approaching zero, unless Germany and ECB can print enough Euros to bail out the bank out. A collapse of Deutsche bank who has $46 trillion derivative value on its books will crash the global stock market and financial market.

On Friday key inflection price level for NQ will be 4845 again.

-- Selling will come back unless NQ can push back above 4845, and then stay above.

-- Trading back below 4845 is likely to attract renewed selling activities, with the next critical support at 4800

Here is a view of Deutsche Bank and Commerzbank share as seen from 1989 to now. While Commerzbank rallied back after the financial crisis “ended,” both Deutsche Bank and Commerzbank have not recovered.

Wednesday, September 28, 2016

NQ Guideline For Thursday

Fed-engineered equity market rally on Tuesday designed to make Janet Yellen, Fed Chairperson looks good for Wednesday's testimony before the House Financial Services Committee on regulation and supervision, failed to continue on Wednesday. NQ simply trades sideways on Wednesday.

The battle between central banks and deflation is going to intensify going forward, and it should cause a rise in volatility.

Support for NQ on Thursday will be 4845.

-- Rally should continue above 4845.

-- Selling activities should come back below 4845, with the next support at 4830.

Tuesday, September 27, 2016

NQ Guideline For Wednesday

As expected, major buy programs triggered as the market open to rescue the stock market from free-fall, continued all day on Tuesday, from the opening bell to the closing bell.

The buy programs is going to continue ahead of the official inclusion of the Chinese Yuan in the SDR basket, and the official launching of the SDR as a new World Reserve Currency replacing the US dollar.

Key resistance for NQ on Wednesday will be 4865.

-- Breaking and staying above 4865 is going to trigger some short-covering

-- Staying below 4865 is going to trigger some profit-taking selling activities. First support is now 4630.

Only Days Until World Money Changes Forever. Quoted from Jim Rickards article

"The International Monetary Fund (IMF) has established a plan for its special drawing rights (SDR) valuation basket to be revised at midnight on September 30. This IMF plan has laid the foundations for a new monetary standard based on world money.

While these SDR plans might seem complex, they’re actually not complicated. People will make it complicated or make it sound confusing but the Federal Reserve has a printing press, they can print dollars. The IMF also has a printing press and can print SDRs. It’s just world money that could be handed out and could be used to cause inflation."

Monday, September 26, 2016

NQ Guideline For Tuesday

A bearish day in the stock market on Monday with NQ opening with a gap-down below breakout price level on the daily chart, 4830, and then remained below 3830 all day. The Dow futures was even more bearish with the low of the day just sitting right at lower bear flag channel that was formed starting about two weeks ago.

Major stock indices including the Dow, the S&P and NQ are setting up a very extreme bearish divergence as can be seen on the daily chart. However, the October selloff is not a guaranteed outcome simply because we do not have a free market. Central banks can still intervene to keep the stock and the bond market elevated by printing limitless amount of money to support the market. The key questions is, how would they do against a rapidly intensifying global deflationary forces.

For NQ, Monday low stayed above its 20-moving average on the daily chart (4800), and with its 50-moving average just slightly below it (4760), NQ would need to break below both the 20 and the 50 moving average to trigger an avalanche of selling algorithm. Until then, selling could remains under control.

Support for NQ on Tuesday will be 4800 and resistance at 4830.

Sunday, September 25, 2016

NQ Guideline For Monday

A profit-taking pullback down day for the equity market on Friday. Whether or not pullback down move has ended on Friday will depends on where it trades in relation to its short-term inflection price level on Monday.

For NQ, key inflection price level on Monday will be 4860.

-- Trading above 4860 is an indication NQ pullback down move has ended, and that it is resuming its uptrend again.

-- Trading below 4860 implies pullback is still in progress, and the next support is 4830 area, a critical support area where NQ should resumes its rally. A clear violation of 4830 support is bearish as it could bring in heavy selling activities.

OECD Warns Fed, BOJ, ECB of Asset Bubbles, “Risks to Financial Stability,” Pinpoints US Stocks & Real Estate

Thursday, September 22, 2016

NQ Guideline For Friday

Several markets opened with a gap-up on Thursday, including NQ, Gold, Silver, Crude Oil, just to name a few. Without any new buyers and sellers, NQ then traded sideways all day.

Central banks will continue to support the stock market with massive buy programs just to ensure the stock market remains high in order to deny Trump Presidency and elect bankers-friendly Hilary.

If the Fed can have their way, going forward into the November Presidential election, look for the stock market to continue to go up, look for Gold and Silver market to continue to go up, look for the Crude Oil market to continue to go up ad the Fed is going to do whatever it takes to keep the ever intensifying global deflationary forces of deflation at bay. Look for the US dollar to decline as the Fed is not likely to change it policy anytime before the US Presidential election.

On the short term time frame, key support for NQ on Friday will be 4830.

-- If NQ stays above 4830 on Friday, selling should mainly be profit-taking activities ahead of the weekend.

-- Should NQ break-back below 4830, selling activities is likely to come back.

Wednesday, September 21, 2016

NQ Guideline For Friday

Now that the Fed policy meeting for September is over and done, the markets can now trend again. With no change in the Fed policy, as expected, and a back door QE through the BOJ, the stage is set for the equity market to rally, for Gold and Silver market to rally, for crude oil to rally, and the US dollar to decline.

For now, the Fed will continue to use "forward guidance", essentially mean lying to the market participant that they will raise rates. There is no way for the Fed to ever be able to raise interest rate without crashing the market. Although it may be part of the Fed plan to crash the market to usher in the new world reserve currency, the IMF world money called the SDR.

Unless the Fed is going to crash the stock market in order to usher in the new world reverse currency, the SDR, to replace the US dollar, look for the stock market to continue to rally.

On the 5-minute timeframe, key support on Thursday will be 4820.

-- As long as NQ can stay above 4820 the current rally should continue. However, the market may just chop around following a large rally like on Wednesday.

-- If for any reason NQ trade back below 4820, look for NQ to trade back to 4795 support.

Tuesday, September 20, 2016

NQ Guideline For Wednesday

The market simply traded sideways on Tuesday ahead of the BOJ and the FOMC policy decision on Wednesday.

Although most market participant do not believe the Fed is going to change policy this time around, selling remains inactive because they do not want to get squeezed by the Fed buy programs, which they are likely going to do after their announcement on Wednesday. Whether or not they can keep deflationary forces under control only time will tell.

Key support for NQ going into Wednesday will be 4795.

-- Trading above 4795 should keep selling under control.

-- Trading back below 44795 is likely to trigger selling, but strong support remains at 4700.

Monday, September 19, 2016

NQ Guideline For Tuesday

Ahead of the Fed meeting this week the major stock market indices in the US traded down, with NQ selling down quite hard, the forces of deflation overwhelmed the Fed buy programs.

As seen on the daily chart, last week rally in the equity market looks choppy and countertrend, especially for the Dow and nasdaq, the pattern is setting up for a liquidation decline.

On the short term intraday timeframe, key inflection price level for NQ on Tuesday will be 4800.

-- Trading above 4800 is likely to keep selling in check.

-- Trading below 4800 is likely to attract selling but buy programs will be active to keep the market elevated.

Sunday, September 18, 2016

NQ Guideline For Monday

Without any new buyers coming to the stock market the market simply traded sideways in a very narrow range on Friday. However, ahead of the FOMC meeting this coming week look for them to engineer massive buy programs in order to keep the uptrend going.

Key support level for NQ on Monday will be 4800.

-- As long as NQ can stay above 4800, sellers are likely to be kept inactive, and the current uptrend on the daily chart can continue.

-- In the event that deflationary forces should overwhelm the Fed, a break below 4800 could attract some selling activities, next support is 4765.

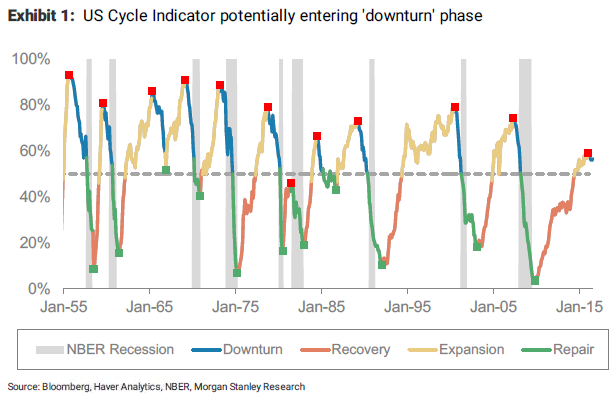

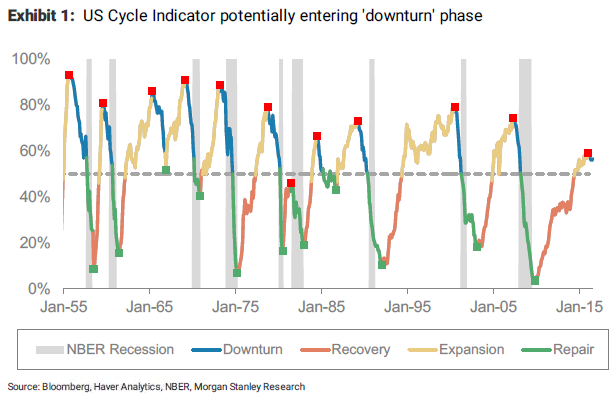

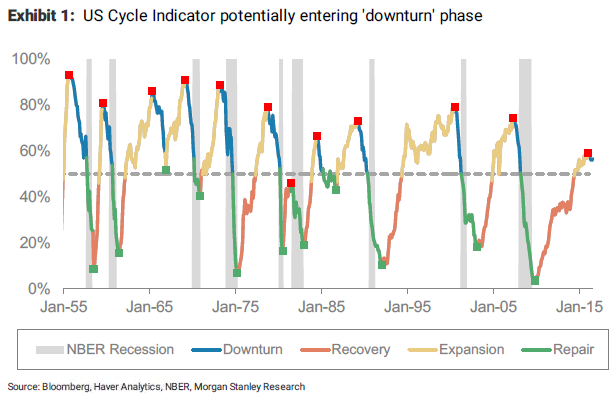

According to new research from Morgan Stanley, so many developed countries are showing enough signs of slowing, that its cycle indicators — which take macro, credit and corporate factors into account — are leading analysts led by Chief Cross-Asset Strategist Andrew Sheets to conclude that a downturn could be coming sooner than some may think.

According to new research from Morgan Stanley, so many developed countries are showing enough signs of slowing, that its cycle indicators — which take macro, credit and corporate factors into account — are leading analysts led by Chief Cross-Asset Strategist Andrew Sheets to conclude that a downturn could be coming sooner than some may think.

Thursday, September 15, 2016

NQ Guideline For Friday

Massive buy programs triggered soon after the open and continued all day long until the close caused a large up day for NQ on Thursday.

With such a large up day on Thursday, it is likely that the market would need to consolidate and trade sideways on Friday before rallying back up again, unless of course the Fed would trigger another round of massive buy programs. Ahead of the FOMC meeting next week, the Fed will want to create an illusion that the economy is doing well, but it is not.

The market is likely to make a higher high above recent high with massive loss in momentum, creating a very bearish divergence, setting up a fast and violent drop sometimes soon. However, if the Fed can help it, they are going to try to hold the stock market up to help Hilary Clinton during the November Presidential election.

For Friday key support for NQ will be 4770.

-- Staying above 4770 would ensure that sellers are kept inactive. If so, NQ either trade sideways or trend up.

-- If for whatever reason, NQ should break below 4770, selling could come back in, but strong support remains at 4700.

Total open interest on the VIX futures recently just reached an all-time high.

Wednesday, September 14, 2016

NQ Guideline For Thursday

With the momentum on the daily chart still in bearish mode, on Wednesday, buy programs failed to break above 4770 key resistance. NQ simply trade sideways on Wednesday. The battles between central banks and deflationary forces continues, with former Fed Chairman Ben Bernanke discussing negative interest rate policy in the US.

With the US dollar value on the line, and global central banks and companies fast unloading US dollar assets, going into negative interest rate may be the trigger to completely collapse the dollar and the entire global fiat money monetary system that has been in place since 1971.

Key price level for NQ on Thursday will be 4770 resistance.

-- Trading above 4770 will keep selling in check, NQ either rally or trade sideways above 4770.

-- NQ will be bearish below 4770, but selling is likely not going to be intense until NQ can break below 4700 support.

Tuesday, September 13, 2016

NQ Guideline For Wednesday

NQ simply traded sideways on Tuesday, stuck between 4700 support and 4740 resistance. The momentum on the daily chart is still negative and is setting up for the next liquidation drop. Whether or not it will happen on Wednesday will depend on where it trades in relation to the 4700-4740 trading range.

Key support for NQ on Wednesday will be 4700.

-- As long as NQ can stay above 4700 selling should remains under control, and NQ either trade sideways or rally.

-- A sustained break below 4700 is bearish, but NQ would need to break below Friday low to run over stop losses and trigger liquidation selloff.

Monday, September 12, 2016

NQ Guideline For Tuesday

Last Friday stock selloff panicked the Fed enough to cause the Fed to turned dovish again. Every time the Fed threatened to raise interest rate, even though most don't believe they will do it, the stock market selloff hard. There will come a time in the very near future when no one would buy the Fed propaganda any longer, and that would be when the market simply unravel. The timing of the collapse is difficult to predict simply because it is no longer an economic event, it will simply be driven by herd mentality.

On Monday, dovish comments by the Fed helps their buy programs pushed the stock market back up to level before last Friday market drop. This kind of whipsaw market action is going to continue going forward as the Fed continues to fight the forces of deflation.

Key support level for NQ on Tuesday will be 4740.

-- As long as NQ can stay above 4740 selling should remains under control, and could rally or simply trade sideways. The next resistance above 4740 is 4800.

-- Trading back below 4740 is likely to bring back selling activities, first support is 4700.

Sunday, September 11, 2016

NQ Guideline For Monday (september contract price level)

The Fed comments on Friday, threatening to raise interest rate, rocked the financial market, the Dow, the S&P500 and Nasdaq ended the day with big losses. Unless they change their tone on Monday, the stock market selloff is going to continue, and the Fed may not be able to hold the stock market up..

The Fed monetary policy is stuck between a rock and a hard place. On one hand, the Fed needs to raise interest rate to support the dollar in order to keep capital flowing into the US to support the economy and to support asset prices including the stock market. But raising interest rate when the economy is technically in recession, will cause the economy and the stock market to crash.

On the other hand, not raising interest rate is going to cause global capital to flow out of the US, causing the dollar to crash and that would cause inflation to skyrocket out of control.

At least for now, the Fed seems preferring to crash the financial market, then likely going to use the excuse of a stock market crash to usher in the new world reserve currency, the SDR, world money issued by the IMF, another fiat money that may temporarily prevent the fiat money monetary system from collapsing, but that would not last very long.

Asian market opened Monday in the red, unless central banks can come up with some announcement to calm the market tonight, the equity market selloff should continue on Monday.

Key price level for NQ going into Monday will be 4700.

-- If NQ can trade back above 4700, selling pressure should subside, and the first resistance is 4760.

-- Staying below 4700 could trigger another round of margin selling, with the next support zone not until 4530 - 4560 zone

Thursday, September 8, 2016

NQ Guideline For Friday - September Contract

Even with continuing massive money creation by the major central banks, it was a generally bearish day in the equity market on Thursday with NQ opening with a gap-down and stayed down when buy programs failed to push NQ back above key broken support.

With all the major indices showing very strong bearish momentum divergence on the daily chart, unless they can push the stock market back up above recent swing high, the bearish divergence condition on the daily chart could become reality, and could trigger sharp selling activities.

Short term timeframe key support for NQ going into Friday will be 4790 and key resistance is at 4815.

-- Unless NQ can break and stay outside support-resistance zone, look for the typical Friday choppy sideways price action.

In August, the worst August since 2013, bankruptcy filings were up 44% from September last year, the low point in this multi-year cycle, and up 29% from August last year:

Wednesday, September 7, 2016

NQ Guideline For Monday

As expected, and without any new buyers, NQ simply traded sideways in a choppy narrow range price action on Wednesday as central banks continues to battle the forces of deflation with more money printing.

As long as the major market indices remains above its breakout price level, around 4700 for NQ, around 2180 for S&P 500 and around 17,900 for the Dow futures, any selling should remains under control, and central banks should be able to print enough money to control the forces of deflation, and control any selling activities.

Key short term support level for NQ on Thursday will be 4820.

-- As long as NQ remains above 4820 on Thursday, selling should be under control, NQ may trend up or traded sideways again.

-- Should NQ clearly break below4820 some selling may come in, next support is at 4800.

Tuesday, September 6, 2016

A Timetable for the Dollar’s Demise

(Quoting Jim Rickards article posted at the daily reckoning)

"The next five weeks will mark one of the most significant transformations in the international monetary system in over 30 years.

What will happen in the next five weeks is just as significant as any of the monetary earthquakes mentioned above. There are three major events happening in rapid sequence. Here’s the list:

- On Sept. 4, the G20 leaders meet in Hangzhou, China

- On Sept. 30, the yuan officially joins the SDR basket of currencies

- On Oct. 7, the IMF holds its annual meeting in Washington, D.C.

You might be tempted to dismiss this calendar as “business as usual.” G20 leaders’ meetings happen every year. The SDR basket has been changed many times in the past. The IMF has global meetings twice a year (spring and fall). But it’s not business as usual. This time is different.

The hidden agenda involves the formal transition from a dollar standard to an SDR standard in world monetary affairs. It won’t happen overnight, but the elite decisions and seal of approval will take place at these meetings.

The SDR is a source of potentially unlimited global liquidity. That’s why SDRs were invented in 1969 (when the world was seeking alternatives to the dollar), and that’s why they will be used in the imminent future."

On Tuesday, the equity market opened flat but after the usual whipsaw early in the morning massive buy programs hit the market that pushed the stock market up all day, with a close at the day high. The buy programs and the rally should continue for a while as major central banks are aggressively ramping up their massive money printing business in order to prevent deflation.

Key support for NQ on Wednesday will be 4800.

-- Selling should be under control if NQ can stay above 4800. Without any new buyers except central banks, we should not be surprise if the market simply traded sideways.

-- If NQ should trade below 4800, selling could come back in, with supports at 4780.

Thursday, September 1, 2016

NQ Guideline For Friday

Another choppy day in the market on Thursday. Another break below previous day low continued to be bought. With NQ remaining above its breakout price level on the daily chart the choppy price action should continue.

With most traders out of their office on Friday for the long labour day weekend we may see a continual choppy price action.

Key inflection price level remains at 4780, trendline resistance is now at 4785.NQ would need to break above 4785 to possibly trigger some sort of short-covering.

Subscribe to:

Comments (Atom)