Wednesday, August 31, 2016

NQ Guideline For Thursday

Another choppy day in the market on Wednesday. NQ violation of 4760 support was quickly bought as the Fed would like to see the market rally ahead of the long labour day weekend. However, without lack of buyers may cause the market to remain choppy.

Key inflection price level for NQ on Thursday remains at 4780.

-- Selling should remains under control if NQ is able to trade back above 4780.

-- NQ should remains choppy below 4780 but above 4760 support.

Tuesday, August 30, 2016

NQ Guideline For Wednesday

NQ has been in a choppy countertrend pullback-down mode on the daily chart for the last two week. Unless NQ can trade back above trend-line resistance which is currently at 4790 the down move should starts to get stronger as strong support is not until 4700, a breakout price level.

On a short-term intraday timeframe, key price inflection level for Wednesday is at 4780.

-- Selling should be under control above 4780.

-- Selling is likely to be back if NQ remains below 4780, with critical support at 4760. A clear and sustained break below 4760 could cause liquidation drop down to 4700 price level, although there is a potential support at 4745.

Monday, August 29, 2016

NQ Guideline For Tuesday

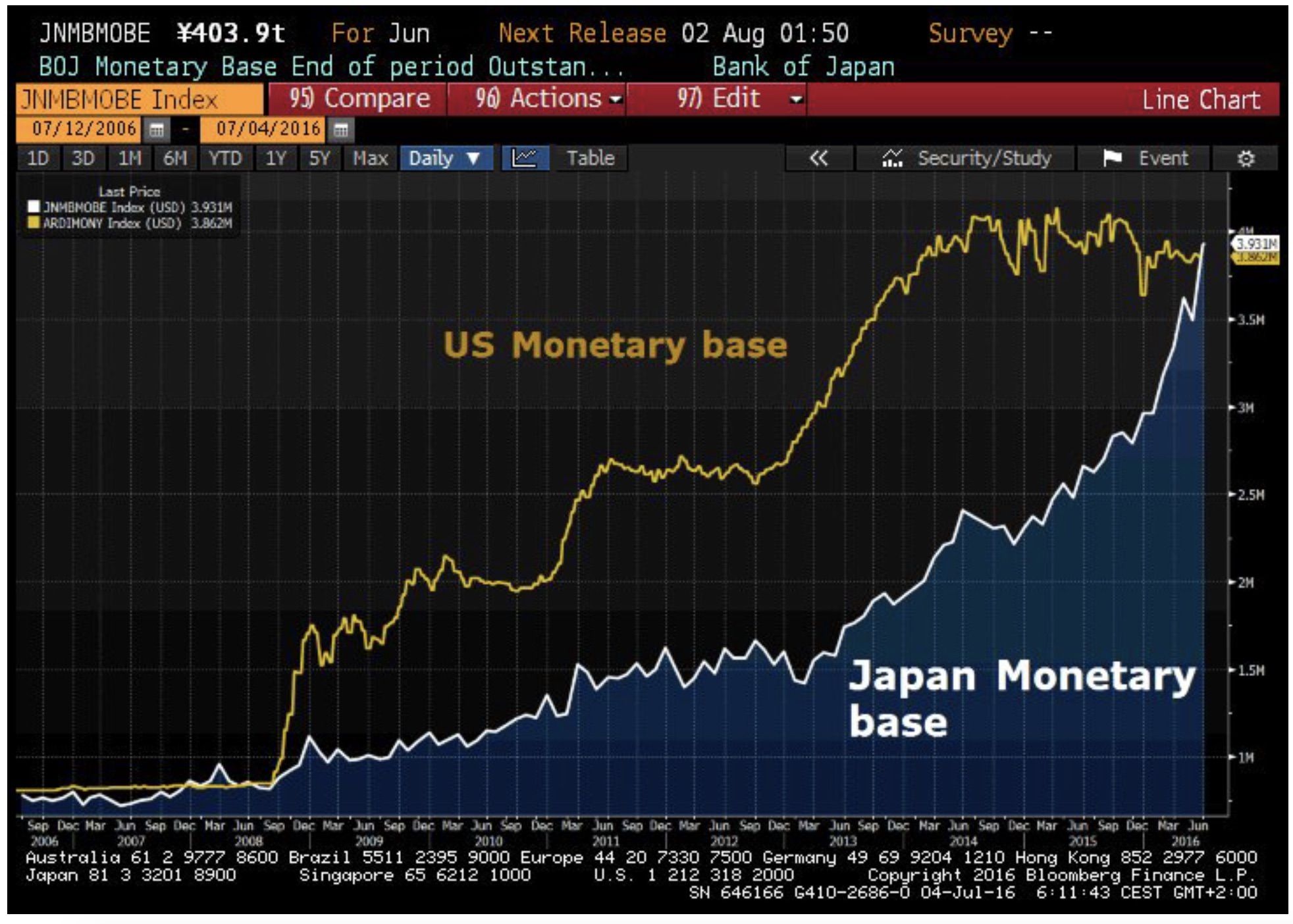

With the Fed not in any position to raise interest rate in order to support the value of the dollar without crashing the stock market, it is now the ECB and the BOJ that has been asked to further increase their already oversized QE amount, in order to weaken their currencies hence strengthen the US dollar.

Strong US dollar is needed to keep the flow of international capital into the US in order to keep the US stock and bond market elevated for the up coming Presidential election in November. The Fed would not want Donald Trump to win, so they will do whatever it takes to create an illusion that the economy is doing well and that the stock, bond and real estate markets are all doing well. However, the forces of global deflation is intensifying and may eventually overwhelm central banks.

The equity market simply traded sideways on Monday even with the ECB and the BOJ threatening to intensity their QE program.

Key inflection price level for NQ on Tuesday remains at 4790.

-- Selling should remains under control if NQ remains above 4790.

-- Selling could come back into the market if NQ should trades below 4790, supports are 4771 then 4745.

Sunday, August 28, 2016

NQ Guideline For Monday

With the Fed policy now totally cornered and not knowing what to do next, the best they could do on Friday at the start of Jackson Hole retreat, was to issue confusing and contradictory statement with Janet Yelling talking about broadening asset purchase programs (QE) and then had Fed Vice Chairman Stanley Fisher to talk about interest rate hike.

On Friday the market reacted by selling off hard, then panic Fed aggressively bought the market to stop the market from crashing. With the fed policy stuck between a rock and hard place, the stage is set for wild market swings, until the Fed can provide firm commitment one way or the other, to ease or to tighten. Without the Fed making firm commitment to ease, the stock market should soon start selling off as deflationary forces intensities.

On the short term timeframe however, key resistance price level for NQ on Monday will be 4790.

-- Selling pressure should be under control if NQ can break back above 4790.

-- Sellers is likely to be active if NQ could not clearly break back above 4790, with the next support at 4745 with strong support at 4700.

Thursday, August 25, 2016

NQ Guideline For Friday

On Thursday, a day before the Fed chairperson is scheduled to speak in Jackson on Friday the market simply traded sideways. The short-sellers were not active knowing that any selling is going to be aggressively met with the Fed buy programs for the Jackson Hole central banks summer retreat.

The Fed is now in a no-win situation. The Fed cannot raise interest rates because it will cause global stock market crash, but at the same time, the Fed cannot ease because it will crash the US dollar. A loss of confidence in the dollar will cause havoc to the global financial system as it will accelerates the speed of global de-dollarization..

So, expect the Fed Chair person Janet Yellen speech to be both dovish and hawkish. If so, look for the stock market to start selling off very soon.

Support for NQ on Friday remains at 4771.

Wednesday, August 24, 2016

NQ Guideline For Thursday

With the Fed destined to project a hawkish stance regarding their interest rate policy when they meet this weekend at Jackson Hole, in order to give some support to collapsing USD and at the same in order to whack gold rally could inadvertently cause a stock market crash in the very near future simply because the market is primed to crash. All it needs is a trigger, and a hawkish Fed may be the trigger for late summer selloff.

On Wednesday, ahead of the Jackson Hole Friday speech by the fed Janet Yellen the stock market sold off and gold was whacked pretty hard. Unless the Fed would tone down their hawkish rhetoric at their Jackson Hole meeting this weekend the stock market selloff may have just begun.

On Wednesday the day low for NQ was right at its key 20-DMA support, a break below is an indication NQ is going down to retest its price breakout level at 4700. Though it is a bit to early to speculate, should NQ selloff clearly break below 4700, an avalanche of sell orders could quickly take NQ down to 4600.

Bearish Divergence below = a setup for stock market crash.

On the short term time frame, on Thursday key support is 4771. A key indicator to watch on Thursday will be hint/s of what Janet Yelling of the Fed would say in her speech on Friday.

-- A clear and sustained break below 4771 could trigger selling that could quickly take NQ down to 4700.

-- Staying above 4771 should keep sellers at bay, first resistance is at 4810.

Tuesday, August 23, 2016

NQ Guideline For Wednesday

Monday night buying programs designed to cause the stock market to open with a gap-up in order to trigger buying did managed to cause a gap-up opening in Tuesday but it failed to trigger any buying interest by investors as NQ slowly decline all day down towards closing the opening gap.

The momentum of the current uptrend on the daily chart has greatly slowed down and the uptrend looks ready for a bigger pullback down. Buy programs continued to struggled, barely able to keep the uptrend going.

On the short term intraday timeframe support for NQ on Wednesday will be 4810.

-- Trading below it could trigger some selling, next support is 4790 then 4771.

-- If NQ can stay above 4810, the next upside target is a break below Tuesday swing high before profit-taking sets in.

Reuters: Bank of Japan's rush into stocks raises fears of market distortions. The BOJ decided on July 29 to expand this stimulus by increasing its annual purchases of ETFs to 6 trillion yen ($60 billion) from 3.3 trillion yen.

Monday, August 22, 2016

NQ Guideline for Tuesday

The US dollar continued to stabilized and remained above 94 on Monday providing much needed relief to the stock market selling pressure. The equity market simply traded sideways in a choppy narrow range pattern on Monday.

As long as the US dollar selling continue to be under control look for the stock market to stabilize and remains in a tight trading range unless they trigger major buy programs.

Inflection price level remains at 4805 for Tuesday supports at 4790 then 4771.

Dow Theory is showing a clear non-confirmation divergence, a warning to potential sharp reversal from the current higher high in the Dow Jones Industrial Average. Whether or not it is still a reliable indicator remains to be seen simply because the current market is very heavily manipulated and controlled by central banks

Sunday, August 21, 2016

NQ Guideline For Monday

With the US dollar sharp decline now on the verge of breaking critical support, as expected, even the dovish Fed governors now turn into hawks and trying to convince the market that they are still going to raise interest rate, which most now do not believe they will do so, the US dollar simply traded sideways on Friday. A pause in dollar selling was enough to stall major selling in the stock market as well, so the market simply traded sideways all day on Friday.

With central banks stock buying activities certain to continue in order to hold the stock market up for up coming US presidential election, and with all the major stock indices still sitting above their breakout level and above key moving averages on the daily chart, it would take a major negative news to cause a sustained selling. Until then, any selling should remain under control. 94 area is key support level on the US dollar index. A sharp and sustained break below 94 could trigger an avalanche of selling that could overwhelm central bank buying, and will cause massive havoc to the global financial market.

Inflection price level for NQ on Monday remains at 4805.

Thursday, August 18, 2016

NQ Guideline For Friday

The market chopped around in a very narrow range on Thursday, but there was again a very big down move in the USD threatening to break below major support which could trigger an avalanche of dollar selling.

Declining dollar is very bearish for the US equity market because it will eventually trigger capital outflow from the US dollar denominated assets and into other markets denominated in other currencies. If so, look for the stock market to collapse.

However, the Fed will not allow the dollar to tank so look for the Fed to talk about raising rates again in order to stop the dollar decline. Whether or not that would stop the dollar decline, only time will tell.

Key inflection price level for NQ on Friday will be 4805.

-- Trading above 4805 implies NQ is either going to trade sideways or rally up to above recent high. However, unless the US dollar decline can take a pause look for buy programs to struggle against an avalanche of selling.

-- Trading below 4805 has the potential to attract selling. However, because Friday tends to be choppy, look for buyers to come in at supports, which are 4790, 4770 and 4745.

Wednesday, August 17, 2016

NQ Guideline For Thursday

With the Fed policy now in a no-win situation the best the FOMC committee could do was to pretend to be in disagreement among the Fed members, just to ensure the financial market continues to be confused as to the Feds future policy on interest rate.

The Fed cannot raise interest rates because it will intensify global deflationary forces, crashing global financial market. The Fed cannot cut interest rate and officially trigger another round of money printing program because that would cause the US dollar to instantly collapse as the exodus from US dollar denominated assets intensifies. So the best the Fed could do is to pretend they are in disagreement.

The market sold off in the morning on Wednesday but buy programs were readied to get triggered in the afternoon to push the stock market back up in order to create an illusion the Fed minutes was positive. Buy programs should continue for a while. Whether or not it could hold off an avalanche of selling activities, only time will tell.

On the short term time frame, key price level for NQ on Thursday will be 4810.

-- If the buy programs can push NQ back above 4810 it should reduce selling pressure. If so, NQ should be able to rally back up to retest recent high.

-- Failure to push back above 4810 would attract more selling, supports remains at 4765 then 4745.

Tuesday, August 16, 2016

NQ Guideline For Wednesday

The equity market simply traded sideways ahead of Wednesday's release of the FOMC minutes from their July meeting. It was a slightly bearish day for all the major stock market indices.

The US dollar also sold off hard on Tuesday, an indication the FOMC minutes may be very dovish, may be signaling no rate hike anytime soon.

Global selling of the US dollar Treasury bond continues and may accelerate going forward as both the IMF and the World bank has now started to issue treasury bond denominated in world paper money, the SDR, to swap with US treasury bond for those who wish to get rid of the US dollar denominated treasury bond, an action that is precisely a prelude to the replacement of the USD as the world main reserve currency.

Key price level for NQ going into Wednesday will again be yesterday's support 4810, and will serve as resistance for Wednesday.

-- Staying below 4810 is bearish and may attract some more selling, with the next support at 4767

-- If they can push NQ back above 4810, and keep it above 4810, NQ may have a chance to break above the recent high.

Monday, August 15, 2016

NQ Guideline For Tuesday

On Monday, as usual, central banks early morning stock buying binge was triggered, and again, it got sold, Monday was no exception. Morning buy programs pushed the Dow, the S&P500 and Nasdaq to new high in the morning. After the early morning rally, NQ traded sideways to down the rest of the day.

With ever increasing amount of money creation by major world central banks the market should continue to rally for a while. The only surprise may come from the Fed minutes to be released on Wednesday August 17. If the Fed provide hint of an interest rate increase soon the market may sell off for a while but continuing central bank purchases of stocks should keep any market decline under control.

On the short term timeframe, NQ support has now climbed up to 4810.

-- Trading above 4810 should keep the current rally alive without a pullback down day. The next upside target is a new high.

-- If NQ break down below 4810 and stay down, we may get a pullback down day. The next lower support is 4790

Twelve days ago, Swiss National Bank made its quarterly filing with the U.S. Securities and Exchange Commission showing large positions in individual U.S. stocks.

In just five tech names, SNB held over $5.3 billion with $1.489 billion invested in Apple; $1.2 billion invested in Alphabet, parent of Google; $1 billion in Microsoft; $803 million in Amazon and $741.5 million in Facebook.

Both Apple and Microsoft are among the 30 stocks that make up the Dow Jones Industrial Average (DJIA), a heavily watched gauge of the U.S. economy’s health. The Swiss National Bank owns over $1 billion in two other names in the DJIA: $1.17 billion in Exxon Mobil and $1.032 billion in Johnson & Johnson.

Sunday, August 14, 2016

NQ Guideline For Monday

NQ traded sideways in a very narrow range on Friday for the second day in a row. Buy programs has started on Sunday night and unless some unexpected bearish news hit the market before regular trading hours started on Monday morning look for NQ to open with a gap-up to be followed by more buy programs in order create a higher highs in the market in order to keep the current uptrend alive.

Key support for NQ going into Monday trading remains at 4795.

-- Selling should remain under control above with NQ trading above 4795, with upside target above last week swing high.

-- Sellers may get more active below 4795, with the next support at 4765 - 4770

Global money printing activities (QE) by central banks to purchase bonds, stocks, mortgages, ETFs, etc., continues to accelerate.

Thursday, August 11, 2016

NQ Guideline For Friday

All the three major indices, the Dow, the S&P500 and Nasdaq all made a new high on Thursday. After making a new high with the usual Fed buy program in the morning NQ again as usual traded sideways for the rest of the day.

The pattern of morning buy programs followed by sideways trading action for the rest of the day should continue for a while longer simply because the Fed needs to create an illusion that the economy is doing well. However, the real economy is doing badly with global deflation forces continuing to accelerates, European banks, the German banks, the Italian banks, the Spanish banks, the French banks, are all collapsing. Deutsche bank on the verge of total collapse.

Even with the world central banks printing at least $200 a month to buy stocks, bonds, real estates, etc, the forces of global deflation is accelerating and would soon lead to a total of the current paper money monetary system if money printing activities continues.

NQ support going into Friday will be 4795.

-- Above 4795 is an indication buy programs is going to try to push NQ to above Thursday swing high before profit-taking pullback.

-- Below 4795 implies a potential pullback day.

Wednesday, August 10, 2016

NQ Guideline For Thursday

As the momentum of the current uptrend started to slow down NQ traded sideways with a slight bearish tone as NQ close the day in the red. Unless the Fed is going to engineered massive buy programs the market may continue to pullback down on Thursday.

Key inflection price level for NQ on Thursday will be 4785.

-- Selling pressure should be muted above 4780 except on a break above recent high due to profit-taking activities by buyers.

-- Selling pressure should continue to drag NQ down below 4785. Supports remains at 4765 the 4745.

Currency War continues. On Wednesday New Zealand Central Bank cut interest rate again. Official global money printing volume is now at about $200 billion a month. The end is now far away.

Tuesday, August 9, 2016

NQ Guideline For Wednesday

As usual, early morning buy programs managed to push NQ up to above Friday's high before pulling back down and traded sideways for the rest of the day.

The current uptrend on the daily timeframe is losing momentum and looks ready for a larger two to three days pullback down to breakout price level before resuming its uptrend, as long as breakout price level now important support level is not violated on any pullback down move.

On the 5-minute timeframe, key support for Wednesday will be 4780.

-- Remaining above 4780 support on Wednesday is an indication that NQ is going to make another higher high before pulling back down.

-- Trading below 4780 implies NQ is in a pullback down mode, next support is 4735 - 4745.

Monday, August 8, 2016

NQ Guideline for Tuesday

Without any major market moving news on Monday the equity market simply traded sideways, NQ simply traded sideways in a very narrow range above 4760 support. The pattern of choppy narrow-range uptrend should continue until the market has a meaningful pullback down day or days.

Support for NQ going into Tuesday remains at 4760.

-- As long as 4760 support is not violated the next upside target is a break above Friday swing high.

-- Breaking below 4760 is an indication NQ is going into a larger pullback with lower support price level at 4735.

Global debt continues to rise exponentially as central banks money printing still remains in full swing. At the current speed, the day of reckoning is not too far away.

Sunday, August 7, 2016

NQ Guideline For Monday

A heavily manipulated employment reports released before the market opening on Friday was a good enough excuse to trigger massive buy programs on Friday morning. However, morning rally faded as it failed to attract any new buyers. Thus NQ then spent the rest of the day trading sideways into the close.

How much longer can the market rally greatly depends on central banks policy going forward. The ECB, the BOJ and the BOE has officially announced more money printing but the Fed is yet to do the same.

The Fed is stuck between a rock and a hard place. They have convinced most market participants of more interest rate increase, and the market has priced in more rate increase, thus officially announcing more money printing will be a complete policy U-Turn, and could cause uncontrollable unintended consequences beyond the Fed's control. Announcing more QE to help Hilary Clinton win the election is a risky proposition. More QE from the Fed should continue to push the market higher but failure to announce more QE soon could intensify global deflationary forces, could cause stock market selloff.

But for now, the daily trend is still up. Absent of major change in central banks policy of easy money, the rally should continue for a while longer. NQ short term timeframe support on Monday has risen to 4760 price level.

-- NQ should remain bullish above 4760.

-- A larger pullback expected on a sustained break below 4760.

According to a Bloomberg article "Helicopter Money" is coming to the US

Thursday, August 4, 2016

NQ Guideline for Friday

A second day consolidation for the Japanese yen and another bounce day for the crude oil helped kept selling pressure in the stock market in check. NQ traded sideways to up on Thursday in a choppy narrow range type of day.

The pattern of choppy up trending type of days should continue as long as crude oil continues to rally and yen continues to consolidate or pullback down. Again, key driver of the stock market would remains the price of crude oil and Japanese yen.

Short-term intraday support for NQ on Friday will be 4735.

-- Trading above 4735 is an indication NQ may continue to rally with the next upside target of a break above Monday's swing high. With Friday tending to be choppy, a break above Monday high could attract some profit-taking selling.

-- Trading back below 4735 implies potential decline down to the next support level at 3700.

First it was the Bank of Japan that first launched helicopter money, then on Thursday the UK central bank has cut borrowing costs, boosted its QE scheme, and committed an extra £100bn to encourage banks to lend and promised to do more if needed. The next to officially announce more money printing is the Fed.

Wednesday, August 3, 2016

NQ Guideline For Thursday

Both the Japanese Yen and the US dollar consolidated and traded sideways on Wednesday thus providing some relief to the selling pressure in the equity market. Rally in the crude oil market also helped reduced some selling pressure in the equity market.

Going forward, the US$/Yen cross rate along with the price of crude oil should continue to drive the price of stocks. A continual decline in the crude oil market and a further sharp rally in the yen could easily crash the stock market that is already in extreme bubble territory when compared to the current economic fundamental conditions.

On the short term timeframe key resistance for NQ on Thursday will be 4730, support is 4700.

-- But more importantly, the dollar-yen cross rate and the price of crude oil will be key driver of trend direction on Thursday.

Tuesday, August 2, 2016

NQ Guideline For Wednesday

Another huge rally in the Japanese yen in spite of massive amount of new helicopter money that was announced on Tuesday. It has now finally started to trigger huge selloff in the equity market as Yen carry trade unwinding has reignited, overwhelming the Fed buy programs. Gold and silver will be one of the major beneficiary of selloff in the stock market.

Unless the current surge in the strength of the Japanese Yen can reverse, the unwinding of the Yen carry trade should accelerate, and that is very bearish for the equity market. Fed governor Lockhart is again talking about interest rate hike hoping that could halt yen rally and prevent sharp dollar decline. However, the Fed has lost most of their credibility, and likely not have any major impact on the direction of the US dollar and Japanese Yen.

On the short term however, NQ resistance on Wednesday will be 4730.

-- Trading back above 4730 should halt further decline in NQ as long as Japanese yen does not have another big rally day on Wednesday. Without a pause or selloff in Yen, selling in the equity market should resume on Wednesday.

-- Trading below 4730 plus a surging Yen has the potential to cause a huge selloff in the equity market.

Monday, August 1, 2016

NQ Guideline for Tuesday

Massive algo buy programs triggered soon after the open on Monday pushed NQ to yet another higher high before profit-taking sets in pushing NQ down then traded sideways the rest of the day.

The pattern of higher high followed by profit-taking pullback should continue for a while longer in order to maintain the illusion that the economy is doing well, but deflationary forces may be temporary defeated but should come back with a vengeance sooner or later. But for now, the rally continues as global money creation accelerates.

Key support for NQ on Tuesday has gone up higher to 4370.

-- Trading above 4370 implies another higher high is the upside target for the next rally leg.

-- Breaking below implies a pause in the current rally.

Subscribe to:

Comments (Atom)