Tuesday, May 31, 2016

NQ Guideline For Wednesday

An attempted pullback down day on Tuesday was aggressive bought late afternoon, buy programs continued into the close.

With the Fed desperately trying to gain back lost credibility by raising interest rate at the June meeting, their plan is to keep pushing the stock market up and up into the June meeting in order to create an illusion that the economy is doing well, but the economy is not. The stock market is set to crash, so even with the Fed continuous buy programs the stock market may still crash, it is just a matter of when.

However, as traders, we must continue to trade the technical as no one knows when the Fed finally looses the battle with the market forces of deflation. The trend on the daily chart is currently up but now in overbought territory, and could experience sharp pullback at any time.

Key support price level for NQ on Wednesday will be 4510.

-- Bullish above 4510, an indication the current uptrend is still in progress without a larger pullback down move.

-- Trading below 4510 implies likely pullback is in progress, but always watch out for the end of day buy programs.

Monday, May 30, 2016

NQ Guideline For Tuesday

The market was closed on Monday. On Friday NQ rally in a choppy NQ had a choppy and narrow-range type of day as most traders were mostly out of the office for the memorial day holiday.

NQ is currently starting to get into an overbought condition on the daily chart and could pullback down for one or two days at any time, a pullback that should be bought unless the selloff gets our of control.

Support price level for NQ going into Tuesday's is 4500.

-- Uptrend to continue without a larger pullback above 4500.

-- A larger pullback if NQ trades much below 4500

Japan warns of "Lehman-Scale" Crisis at G7 meeting

Thursday, May 26, 2016

NQ Guideline For Friday

A very narrow-range very low volume sideways consolidation day in the market on Thursday, the second day in a row, as the only buyer is likely just the Fed holding the market up ahead of the long weekend.

On Friday, with most traders out of the market for the long weekend holidays, it is likely to be another choppy narrow range day again, unless of course some buy programs would come in from nowhere.

Key price level for NQ on Friday will be 4500 resistance. and key support will be 4470

Wednesday, May 25, 2016

NQ Guideline For Thursday

Following a gap-up open on Wednesday, without any new buyers NQ simply traded sideways below 4500 resistance, in a narrow range pattern, in a very low volume condition.

For Thursday key price level to gauge trend direction will be 4500 resistance.

-- Failure to clearly break above 4500 could bring in some selling, first support is 4440 then 4400.

-- If they can get NQ to break and stay above 4500 short-term algos could be persuaded to buy.

Tuesday, May 24, 2016

NQ Guideline For Wednesday

NQ opened with a gap-up on Tuesday. It was then immediately followed by massive algorithm buy programs that lasted all day long into the close. The Fed buy programs is likely to continue into Friday for the long weekend window dressing.

Key support for NQ going into Wednesday trading will be 4400 strong resistance now should act as strong support.

-- Sellers should be kept at bay with NQ trading above 4400. If so, NQ either rally or trade sideways.

-- Seller will be back if NQ should clearly break below 4400.

Deutsche Bank upcoming implosion is going to take the global financial system with it.

Monday, May 23, 2016

NQ Guideline For Tuesday

A narrow-range down day for NQ on Monday, closing right at 4350 key support, setting up a potential opening gap-down day on Tuesday, unless of course they can keep NQ above 4350 by the opening bell on Tuesday.

With the forces of global deflation intensifying, the Fed and other major central banks are fighting a losing battle. On Monday, Moody's downgrades Deutsche banks rating to just above junk. the bank is fast approaching bankruptcy stage, the impact could be very devastating to global financial system because Deutsche bank is one of the biggest holder of derivatives, which will implode in a case of the bank insolvency.

On an intraday timeframe, key price level for NQ on Tuesday will be 4350.

-- Shorts will be kept in check above 4350, implies a consolidation or a rally day.

-- A selloff could occur with NQ trading below 4350, next support is 4330 then of course the well defended 4300 price zone.

On a longer term time frame, the S&P 500 is now at key inflection price zone. A selloff from current price level could trigger the dreaded death cross, a cross under of the 50-ma below 100-ma on the weekly chart.

This “statistically significant” death cross has only happened twice is the past two decades, The first took place in 2001 and was followed by a 37 percent decline in the index, while the second pattern occurred in 2008 and preceded a 48 percent drop.

Sunday, May 22, 2016

NQ Guideline For Monday

On Friday, the market opened with a gap-up, then buy programs were immediately triggered designed to cause short-covering rally but it ran out of gas, and selling came in at around lunch hour that lasted into the close.

The war between the Fed buy programs and global deflationary forces will continue until the Fed loses. With global deflationary forces intensifying, the Fed has to substantially increase its money creation program if they are to forestall a global stock market crash. However, the Fed has to continuously juggle between preventing the dollar collapse or the stock market collapse, one or the other, and it cannot be both.

On an intraday timeframe, key support level for NQ on Monday will be 4330. The trend on the daily chart is just about to change from down to up.

-- As long as an decline does not clearly violate 4330, NQ rally should continue, next resistance is again 4400.

-- Breaking below 4330 implies the downtrend on the daily chart is still alive, first support is again 4300.

Thursday, May 19, 2016

NQ Guideline For Friday

On Thursday NQ opened and immediately started selling off, dropping down below 4300 key support but was met with relentless buying algos that managed to push NQ back up to the opening price level by the close.

With NQ still in a downtrend mode on the daily chart, still trading below its 20-DMA and 50-DMA, look for rallies to get sold until NQ can get back above 4400 price level. So until then, any longs should be exited at the end of the day.

For Friday 4300 will remain a key support price level. Trading above 4300 implies sideways price action. However we should not be surprised to see buy programs designed to push the market up, fighting global deflationary forces.

Below is a chart showing debt default rate among energy companies going parabolic, causing massive deflationary forces.

Wednesday, May 18, 2016

NQ Guideline For Thursday

The market tanked hard after the released of the FOMC minutes on Wednesday. The FOMC minutes clearly indicates the Fed is in panic mode, as they continue to juggle between keeping the dollar from collapsing and keeping the gold price suppression scheme from imploding, not an easy task. Dollar collapse, stock market crash and gold uncontrollable rally is not that far away.

Again, NQ dropped down to 4300 support and bounce, making 4300 key price level to watch on Thursday.

-- Trading above 4300 implies more consolidation or rally day for NQ.

-- A clear break below 4300 is going to trigger an avalanche of sell order.

Here is a potential equity market trajectory going forward.

Tuesday, May 17, 2016

NQ Guideline for Wednesday

With NQ opening below 4400 key resistance price level on Tuesday, a wave of algo short selling hit the market hard, erasing all of Monday's ramp job gains, dropping NQ back down towards key support price level of 4300 which has been fiercely defended for over two weeks.

The next time NQ breaks below 4300 it could cause an avalanche of sell orders that could overwhelm the Fed buyers. So key price level for Wednesday has to be 4300 support level.

- A clear and sustained breaks below 4300 could trigger relentless selling, next support is at 4200 then 4100.

- Staying above 4300 could cause a sideways consolidation pattern with first resistance now at 4350, or another ramp up job to 4400 again.

The trend on the daily chart remains in a down mode.

Monday, May 16, 2016

NQ Guideline for Tuesday

With signs of economic recessions becoming more obvious by the day, panic Fed engineered one of their biggest ramp job on Monday pushing the stock market up all day, running over short-sellers.

With QE4 perhaps coming in not too distant future, look for the frequencies of their ramp job to accelerates going forward. How long will the effect of QE4 last, there is no way to tell, but it should be short-lived, as the power of the market will overrun and humbled central bankers.

As shown below, in a number of cases over the past century, a bear market in U.S. stocks was well underway long before a recession had been recognized and confirmed by the Fed. This is why waiting for the confirmation of a recession, before taking actions to protect investment portfolio, will likely too late.

With the economy now more than 6-years into an expansion, which is long by historical standards, the question for you to answer by looking at the above charts.

“Are we closer to an economic recession or a continued expansion?”

How we answer that question should have a significant impact on our investment outlook as financial markets tend to lose roughly 30% on average during recessionary periods. However, with margin debt at record levels, earnings deteriorating and interest rate spreads narrowing, this is hardly a normal market environment within which we are currently invested.

Key price level for NQ on Tuesday will be 4400 resistance.

-- If NQ is unable to break and stay above 4400 look for NQ to either trades sideways or selloff, with key support at 4350.

-- If they are successful in pushing NQ above 4400 look for some shorts to cover.

Sunday, May 15, 2016

NQ Guideline For Monday

Another sideways trading pattern for NQ on Friday as the Fed buyers continued to defend the 4300 support level because they know that a clear and sustained break below 4300 is likely to trigger an avalanche of selling that could easily get out of control.

For Monday, inflection price level for NQ will be 4330. The trend on the daily chart remains in a down mode.

-- Bearish below 4330 but key support remains at 4300 price level.

-- Bullish above 4330, with first resistance at 4350.

Thursday, May 12, 2016

NQ Guideline For Friday

On Thursday NQ opened and then tanked all morning breaking through several support levels before stopping just above well defended 4300 support. The Fed buy programs with the help of the end of day profit-taking helped propel NQ back up to 4350 resistance level.

4350 will be key inflection price level for NQ on Friday.

-- If buy programs can pushed NQ back up above 4350 resistance, short-covering should help propel NQ further up to higher resistances, 4370 then 4400.

-- Failure to break and stay above 4350 could attract short-selling, key support is again 4300.

Note that the trend on the daily chart is still down. NQ is currently still trading below its 20-DMA.

Kyle Bass, the hedge-fund manager who’s wagering on a slowdown in China’s economy, said Hong Kong’s property market is in “free fall” and the credit expansion in Southeast Asian emerging markets will unravel.

“Hong Kong’s in a worse position than it was in prior to the ’97 crisis today,” Bass said at the SkyBridge Alternatives Conference in Las Vegas on Wednesday. He said credit in Asian emerging markets has grown “recklessly,” citing Malaysia and Thailand.

Wednesday, May 11, 2016

NQ Guideline For Thursday

On Wednesday, early morning rally for NQ failed to break above 4400 resistance. As expected, its failure to clearly break above 4400 attracted short-selling. NQ then sold off the rest of the day, closing near the low of the day.

Key inflection price level for NQ on Thursday will be 4370.

-- Unless NQ can break back and stay above 4370 on Thursday look for selling to continue. Supports are 4350 then 4320.

-- Trading back above 4370 is likely to cause some short-covering, with first resistance at 4400

Tuesday, May 10, 2016

NQ Guideline For Wednesday

As the annual bearish period that usually begin in May approaches, the market continued to be engineered higher on Tuesday, the third up day in a row, making Wednesday a key day for the market.

A continuing rally on the fourth day may indicates the downtrend as seen on the daily chart that started in the middle of April may have ended, an indication the pervious uptrend may have resumed.

For NQ however, it is currently approaching key resistance zones between 4400 and 4440. A break above 4440 implies an uptrend on the daily chart has resumes, but failure to do so is likely to attract another round of sell programs.

On a short term five minute timeframe, key price level on Wednesday will be 4400.

-- Staying below 4400 is likely to attract some selling. if so, the first support is 4350.

-- A break above 4400 is going to trigger some buying, next resistance is 4440.

Monday, May 9, 2016

NQ Guideline For Tuesday

Monday rally fizzled into the close as profit-taking and short-selling pushed NQ down into the middle of the day range at the close. With the daily chart still in strong down trend traders will be looking to sell rallies on Tuesday.

Key support for NQ on Tuesday will be 4320.

-- As long as NQ can stay above 4320, most short-sellers will be on the sideline. A rally up to 4400 could attract heavy selling activities that could push NQ back down.

-- Breaking below 4320 has is likely to attract algo sell programs, with the next support at 4300.

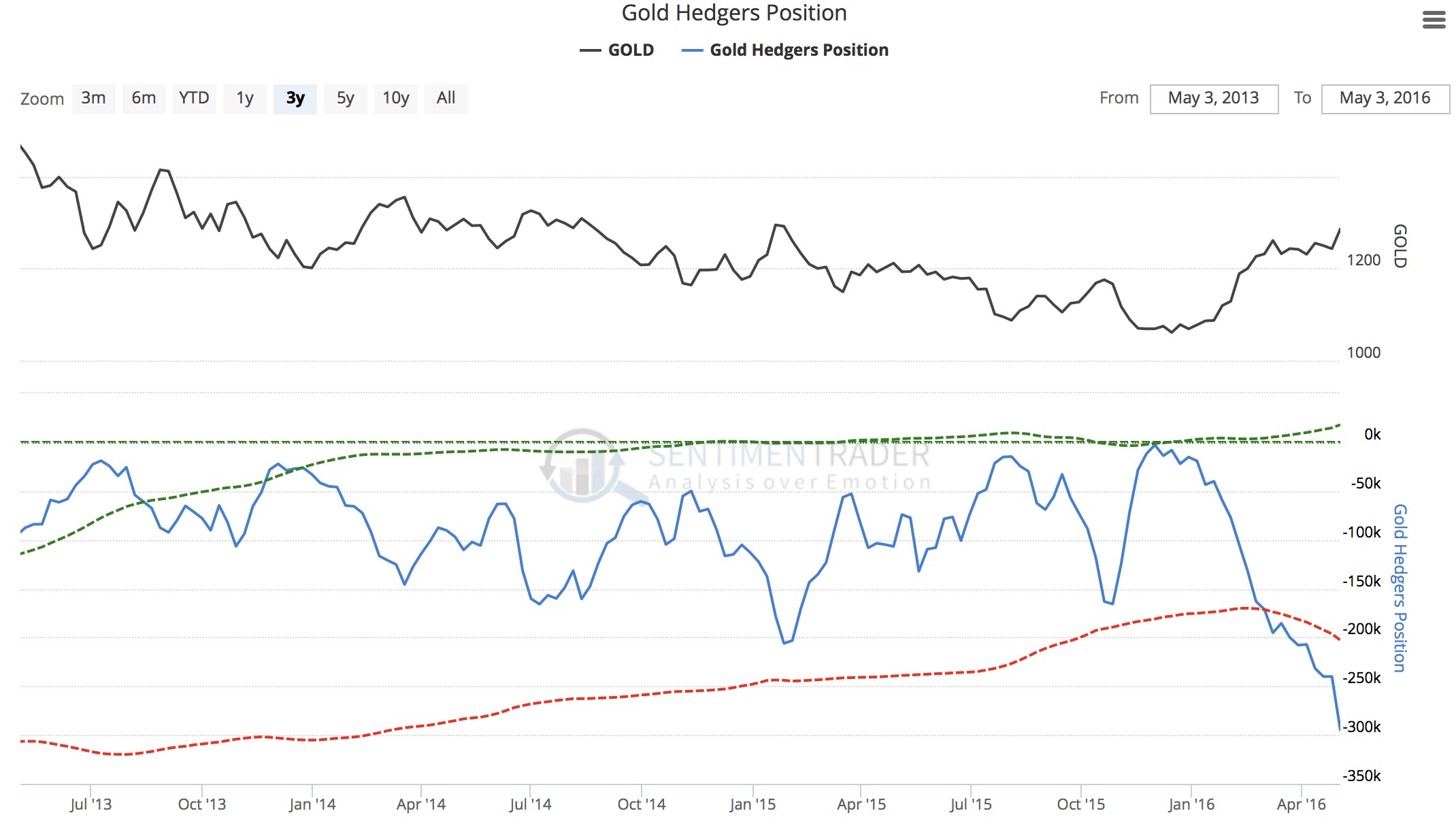

With central bankers on the verge of losing their battle with gold, on Monday heavy selling activities just managed to push gold down about $30 per ounce.

Commercial Short Positions In Gold Near All-Time Highs

Sunday, May 8, 2016

NQ Guideline For Monday

On Friday, after spending most of the morning below 4300 key support price level, massive buy programs in the afternoon managed to push NQ up to 4325 resistance, and then closed just above 4325 resistance, setting up a potential short-covering rally on Monday, unless of course NQ trades back below 4325 key inflection price level for Monday.

If NQ failed to stay above 4325 is likely to trigger some selling, first support is at 4300. NQ needs to break back below 4300 to be bearish.

If NQ can stay above 4325 on Monday it is likely to trigger some short-covering, nest resistance is 4370.

With major central banks on money printing binge, they are beginning to lose control of their gold price suppression scheme. A total loss could rocket gold price into the stratosphere.

Thursday, May 5, 2016

NQ Guideline for Friday

Another sideways consolidation above 4300 well defended key support price zone on Thursday. However, with the release of the monthly employment report on Friday, and after five consecutive day consolidation above 4300 level, NQ may be ready to move away from the 4300 price zone, moving away upwards or downwards.

For Friday, 4300 remains the key support price level for NQ. A clear break could cause liquidation decline. Remaining above 4300 could produce either another sideways price action, or a rally if it can trigger some end of the week short-covering.

Wednesday, May 4, 2016

NQ Guideline For Thursday

NQ traded sideways above 4300 key support most of the day on Wednesday as the Fed buying algorithm was parked at 4300 support, knowing that a clear and sustained break below 4300 is likely to unleashed selling activities that can easily get out of control. For Thursday look for 4300 to again be well defended price zone.

4300 would continue to be key support for Thursday.

-- NQ trading above 4300 is likely to keep short-sellers at bay. First resistance is at 4325.

-- Should 4300 support clearly breaks and triggers algo sell programs, lookout below. next support is at 4100

Japanese Central Bank BOJ is now the top 10 shareholders in about 90% of Nikkei 225 companies.

Tuesday, May 3, 2016

NQ Guideline For Wednesday

NQ opened with a gap-down on Tuesday. After spending the morning trading sideways, afternoon buy program failed to close the gap, an indication of a strong selling pressure leaving may longs trapped and still holding on to their position. Unless NQ can rally back up to 4375 resistance on Wednesday and let them out, and instead sell-off, the longs would have to bail likely causing a liquidation decline.

Key inflection price level for NQ on Wednesday will be 4340 area.

-- Trading above 4340 would keep short-sellers at bay until NQ rally up to 4375 area.

-- Trading below 4340 will be bearish but NQ would need to break below 4300 to trigger massive algo sell programs

Bear Market Rally In Stocks may be topping. When Gold Breaks $1,300 Look For Serious Upside Acceleration

Monday, May 2, 2016

NQ Guideline For Tuesday

On Monday NQ opened and stayed above 4300 key support. The after consolidating sideways all morning buy programs came in the afternoon sending NQ up to 4375 resistance, and staye there at the close.

On Tuesday key price level for NQ will be 4375 resistance.

-- Bullish above 4375 and likely to force some shorts to cover. if so the next resistance is at 4400.

-- Failure to break and stay above 4375 could cause some selling, with supports at 4340 then 4325, then 4300. NQ would need to break below 4300 to trigger another round of liquidation decline.

According to the Center On Budget & Policy Priorities nearly 75% of every tax dollar goes to non-productive spending.

Sunday, May 1, 2016

NQ Guideline For Monday

NQ continued to sold off on Friday, dropping down to 4300support before end of the week profit-taking sets in pushing the close above day low.

With NQ daily chart in a downtrend, it is just a matter of whether we would get a pullback up day on Monday or a continuation of daily chart downtrend.

Key support for NQ on Monday will be 4300.

-- Trading above 4300 should keep short-sellers at bay until NQ has rallied up to resistance at 4375 area. Should 4375 proved itself as resistance, look for short-sellers to come back aggressively.

-- Trading below 4300 is likely to trigger another round of algo sell programs, next support is at 4100. However, I don't expect NQ to hit that level in one day, but it would not surprise me if it does

Subscribe to:

Comments (Atom)