Thursday, July 30, 2015

NQ Guideline For Friday

After a sharp sell-off soon after the open on Thursday large buy programs likely triggered by the Fed buyer reversed the market from down to up in a V-shape reversal that caught short sellers by surprise, without a re-test to get out, the shorts panicked and covered, triggering a short-covering rally that lasted all day into the close.

Thursday day high is just below strong resistance zone at 4600, which should serve as the key price level for Friday.

-- If NQ can open with a gap above 4600 and stay above, or rally, break and stay above 4600, with or without a pullback, short-covering should continue, next resistance is at 4635.

-- NQ may need to go into a pullback mode below 4600, with first downside target at 4575

Wednesday, July 29, 2015

NQ Guideline For Thursday

A choppy sideways consolidation type of day for NQ on Wednesday even after the FOMC announcement, a doji day for NQ as seen on the daily chart. A doji day is often followed by a trend move the next day, but the direction is not certain as it depends on where it trades in relation to the closing price.

Closing price for NQ on Wednesday is 4564.75, a key inflection price level for NQ on Thursday.

-- Trading below 4565.75 is an indication NQ is going down targeting 4500, with potential support at 4545 that could reverse the trend back up again. But the two day rally looks choppy and counter-trend. If so, NQ downtrend should resume and break below 4500 support level going forward.

-- Trading above 4465.75 and rallying is an indication short-covering should continue, targeting a re-test of the recent high, with 4600 and 4635 as resistance price level.

Tuesday, July 28, 2015

NQ Guideline For Wednesday

Ahead of the FOMC policy announcement due on Wednesday, massive buy programs triggered by the Fed as the market dropped down to test key support, at 4500 price level for NQ, a short-covering rally ensued lasted all day, with the close at the day high.

The buy programs should continue on Wednesday with or without a pullback, and as long as they can hold NQ above 4525 support, the rally should continue, with key resistance at 4560.

With the Chinese stock market bouncing off extreme oversold condition that could last for 3 to 4 days, look for the equity market to rally as well. A clear and sustained break above 4560 should trigger more short-covering, targeting a re-test of the recent high.

The Chinese stock market should continue to crash after the 3 to 4 days dead cat bounce, so far mimicking the 1929 wall street stock market crash

Monday, July 27, 2015

NQ Guideline For Tuesday

A strong sell-off day for NQ on Monday following China's stock market crash on Sunday night. With the FOMC meeting on Tuesday and Wednesday the Fed is certain to aggressively buy the market. Whether or not they will succeed only time will tell.

Key price level to watch for on Tuesday will be 4555 resistance and 4500 support.

-- Bullish above 4555, on a clear and sustained break above it, shorts may start to cover, propelling short-covering rally.

-- NQ would remain in a bearish mode below 4555, but it would need to break below 4500 to trigger another round of liquidation decline, next support will be 4440, then 4400 and 4340.

-- Staying inside the 4500 - 4555 range could result in a choppy sideways trading pattern.

Sunday, July 26, 2015

NQ Guideline For Monday

NQ tried to rally on Friday but eventually broke down below 4600 key support price level, then after re-testing it from below sold off hard all the way down to just below strong support 4555 before finding support at 4545 and then rallied into the close as the shorts took profit.

For Monday, NQ either traded sideways or trend back down to lower price level, and would depends on market conditions and where it trades in relation to its key inflection price level.

Key inflection price level for NQ on Monday is 4560.

-- If NQ can stay above 4560 price level, selling pressure should subside and that it could trade sideways or rally up to 4600 key resistance level. NQ would need to break-back above 4600 to turn bullish.

-- Any rally attempt that failed to clearly break above 4600 would attract another round of selling. However, NQ would need to clearly break below 4540 to trigger a liquidation sell-off, if so, downside target is at 4350 provided it can break below 4500 support.

Thursday, July 23, 2015

NQ Guideline For Friday

After trading down all day breaking below Wednesday's swing low NQ rallied sharply into the close on the back of Amazon's earning reports. If it can sustained the end of day rally and break up above 4635 NQ could trigger a short-covering rally that could propel it up to test the recent high. Resistances are at 4655, 4670 and then 4687.

Failure to rally and stay above 4655 could trigger short-selling that should tank NQ back down towards the 4600 support.

NQ would need to break below Thursday low to trigger another round of sell programs, next lower support is prior resistance now support at 4555, and it should be a very strong support zone.

Wednesday, July 22, 2015

NQ Guideline For Thursday

A huge gap-down for NQ on Wednesday but then spend the rest of the day consolidating the huge gap. Wednesday was the second pullback-down day, so Thursday could either be a rally day or a rally up to 4655 resistance and then sell-off, making it a sell-off day.

As long as NQ can stay above 4600 it should rally up towards 4655 key resistance.

-- Failure to break above 4655 resistance could send NQ back down to 4600 support, and if that support is violated, NQ should come down to test breakout level now support at 4550.

-- Breaking above 4655 could trigger short-covering rally.

Tuesday, July 21, 2015

NQ Guideline For Wednesday

NQ traded sideways on Tuesday but sold-off hard, down over 60-points after the close, following several earning reports. Unless the Fed buyers can manipulate the market up overnight the NQ is set to sell-off at the open

Key price level for NQ on Wednesday will be 4665

-- If NQ opens below 4665 and fail to break back above 4665, it is going into a sell mode with key support at 4600. If 4600 support does not hold, look for selling to continue down toward breakout price level at 4550.

Monday, July 20, 2015

NQ Guideline For Tuesday

After a brief choppy sideways action after the open short-covering continued in NQ and rallied all day with the usual small profit-taking decline at the end of the day.

The uptrend should continue as long as any pullback decline can stay above key support level as the The Fed should continue to be relentless in pushing the market up in order to continue to trigger short-covering to propel the market higher.

Key support for NQ on Tuesday will be 4665.

-- Above 4665 implies extreme short-covering is continuing, next resistance is still at 4700.

-- Trading below 4665 is an indication the current short-covering rally is in a pause mode, key support is at 4640.

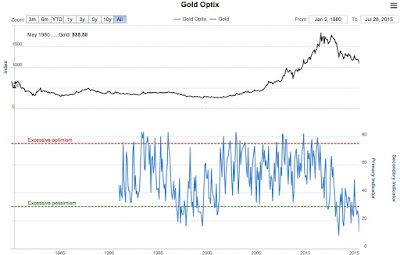

Massive Sunday night speculative attack by gold short-sellers tanked gold down very hard, the attack designed to take out all the stop-losses that reside below prior low at around 1145 on the August gold future contract, which is now resistance on any rally.

Sunday, July 19, 2015

NQ Guideline For Monday

Helped by international capital fleeing the European and China's financial crisis and flowing into the US market, the Fed is finally successful in forcing the short-sellers to cover, triggering relentless short-covering rally that would last until most of the shorts has covered.

This is likely the final up-leg or wave on the daily chart before the market top and then reverse violently just like the recent Chinese stock market crash which collapsed about 30% in just over a week. The major US equity market indexes are currently setting up a capitulation top before reversing violently.

Where and when the market tops is anyone's guess, but for now key support for NQ on the daily chart is 4550. As long as NQ can stay above 4550 the uptrend is still in progress, with the next psychological resistance is at 4700.

Key intraday support for NQ on Monday is 4525.

-- Above 4525 implies NQ is still in a fast uptrend, with the next resistance at 4700

-- Trading below 4525 is an indication NQ is going into a consolidation pullback-down mode, next support is 4600.

Thursday, July 16, 2015

NQ Guideline For Friday

NQ opened with a gap-up above quadruple-top high and stayed above it, triggered short-covering rally that lasted all day long with a close at the high of the day.

Key price level is now quadruple-top prior resistance 4550, now turned into support.

-- As long as NQ can stay above 4550 short-covering should continue with the next upside target at 4625, 4650hen 4700.

-- Breaking back below 4550 should trigger algo sell programs

Wednesday, July 15, 2015

NQ Guidline For Thursday

A sideways narrow range up day for NQ on Wednesday, but still trading below quadruple top. NQ would need to break above the quad top quickly as failure to do so could attract profit-taking short-selling activities that can tank it down to 4470 support.

Key price level for NQ on Thursday will be 4515.

-- Uptrend should continue above 4515, resistances are 4540, then 4555

-- Bearish below 4515, with first support at 4500.

Tuesday, July 14, 2015

NQ Guideliene For Wedensday

Another up-trending day for NQ on Tuesday, the 3rd up day in a row, and not far from it quadruple-top resistance price level.Whether or not NQ would consolidate of pullback down below prior top 4550, only time will tell.

NQ pullback down into the close on profit-taking. As long as profit-taking down move does not violate key support 4500 price level, NQ should continue to rally and may break above quadruple-top 4550 area.

Breaking down below key support 4500 is an indication NQ is going into a consolidation pullback mode. If so, downside pullback target and support is at 4470-4480 area

Monday, July 13, 2015

NQ Guideline For Tuesday

Propelled by massive central banks buying binge on Sunday night designed to cause a huge gap-up open in order to trigger a panic short-covering by the short-sellers on Monday, the market did exactly just that with NQ opening up and rally as the shorts were squeezed.

NQ is now nearing another key resistance price level at 4500 that could cause some pullback or consolidation before rallying back up again -- as long as pullback down move does not violated key support level, which is the 4430-4440 area.

On the other hand, if NQ can push above 4500 and then able to stay above 4500 or gap-up open above 4500, then we could see another rally to test the recent swing high.

US dollar (UUP ETF below) breaking above contracting triangle's upper channel resistance, which could run-over some stop-loss and cause a quick spike upwards..

NQ Guideline For Monday

A large gap-up open for NQ on Friday. Although it rallied all day long NQ remained below 4440 key resistance level, which will continue to be key resistance price level on Monday.

Greek debt relief negotiations with the European is going to continue to influence the market and can cause unpredictable choppiness in the market, but key resistance for Monday will be 4440 and key support at 4400.Higher resistance is 4470, and lower supports is 4375

-- Failure to trade above 4440 could attract short seller back into the market with key support price level at 4400.

-- A break above 4440 could cause a short-covering rally.

Greek debt relief negotiations with the European is going to continue to influence the market and can cause unpredictable choppiness in the market, but key resistance for Monday will be 4440 and key support at 4400.Higher resistance is 4470, and lower supports is 4375

-- Failure to trade above 4440 could attract short seller back into the market with key support price level at 4400.

-- A break above 4440 could cause a short-covering rally.

Thursday, July 9, 2015

NQ Guideline For Friday

Another bearish day in the market on Thursday with NQ selling off right from the opening bell into the close, down to strong support zone. As long as NQ remains below 4400 price level, selling pressure should continue to dominate the market.

NQ has now traded back up in after hour globex trading, central banks using Greece as an excuse for them to buy the market during thin overnight trading session. Where it opens and trade on Friday morning will be key for trend direction

Key price level for NQ on Friday will be 4400.

-- A sustained break above 4400 is likely to trigger some profit-taking short-covering rally with 4440 as strong resistance zone, and a break above 4440 should propel NQ up to 4470.

-- Below 4400 sellers should return with first target down is triple-bottom level at 4335 area, with lower support price level at 4325 and 4300.

After Greece submitted their new proposal to the Troika S&P Futures rallied.

Wednesday, July 8, 2015

NQ Guideline For Thursday

NQ opened with a gap-down and trend back down to Wednesday's support, only with the closing of the NYSE might have prevented a massive sell-off that could have crashed NQ down through prior day low.

Key inflection price level for NQ on Thursday will be 4370.

-- Trading below 4370 is an indication NQ is still in a strong downtrend and may crash down through double-bottom support. However, it would require a very bearish market conditions for NQ to break below strong support zones at 4325, 4300 and then 4275.

-- Trading back above 4370 would relieve some selling pressure. Resistances are 4400 and then 4440.

Chinese stocks crashes most since 2007 amid "Panic Sentiment"

Tuesday, July 7, 2015

NQ Guideline For Wednesday

Dragged down by the European market selloff the US equity indices opened and tanked down hard in the morning on Tuesday with NQ dropping down to major support before the Fed buy programs were able to push it higher into the close.

NQ has declined back down over 40 points during globex trading so far tonight. Unless NQ can rally back above 4470 the trend on the daily chart remains down.

On a smaller time frame, key price level for NQ on Wednesday will remain at 4440.

-- NQ will remain bearish below 4440, and with supports at 4400, 4370, 4335.

-- Trading above 4440 has the potential to trigger short-covering, but NQ would have to break and stay above 4470 to turn it into an uptrend on the daily chart.

Monday, July 6, 2015

NQ Guideline For Tuesday

Global markets tanked very hard after the NO vote won in the Greeks referendum, however, coordinated intervention by major central banks to support the markets managed to pushed the market up back into neutral territory by the time New York market opened.

NQ morning rally again failed to break above strong resistance at 4440 price level for the third time, as NQ sold off again testing the day low before another rounds of buy programs pushed NQ back up to near the day high.

4440 should serve as a key price level for Tuesday.

-- Staying below 4440 is bearish and could attract another round of short-selling with key support at 4370.

-- Trading above 4440 is likely to trigger some short-covering, next resistance is at 4470.

Sunday, July 5, 2015

NQ Guideline For Monday

Now that the Greek's referendum is over and the NO to the Troika's deal has won, the stage is set for grexit and the breakup of the European Union

The NO vote sent the global equity market downward even with the coordinated efforts by major central banks to support the markets and prevent global panic.Where the market opens on Monday will be key to determining market direction. NQ globex low was down to strong support zone between 4300 to 4340.

As long as 4300 support zone can hold on any downdraft we could see the market stabilize and then rally back up to recent high provided it can break-back above key resistance at 4470 zone.

A clear break below 4300, however, is likely to tank NQ all the ways down to 4100 support price zone.

Thursday, July 2, 2015

NQ Guideline For Friday

Another sideways price action for NQ on Thursday ahead of the long 4th of July weekend holidays.With the Fed determined to keep the market up for the long weekend, if the Fed has their way, look for the market to remain in a choppy sideways action. However, caution is warranted as the upcoming Greek's Sunday referendum has the potential to wreck havoc on the market.

Key price level for NQ on Friday will remains at 4400 - support and 4440 as resistance.

-- NQ would remains in a neutral mode above 4400, resistance is at 4440 and 4460.

-- Bearish below 4400 and could trigger major algo sell programs that could tank the market.

The market remains in overvaluation territory

Wednesday, July 1, 2015

NQ Guideline For Thursday

Tuesday night buy programs designed to cause a huge gap-up open on Wednesday in the hope of triggering short-covering rally failed on Wednesday as the opening gap-up was sold, pushing NQ back down to key support 4400 price level.

Another round of buy programs in the afternoon failed to gain much momentum as NQ close just in the middle of the day range. The daily chart remains in downtrend sell mode below 4470.

Key price level for NQ on Thursday remains at 4400.

--- Trading above 4400 is an indication NQ may continue to be in a choppy mode, with resistance at 4420, 4440 and 4460.

--- Below 4400 is bearish and could trigger another round of liquidation sell-off.

Subscribe to:

Comments (Atom)